Kodak 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

81

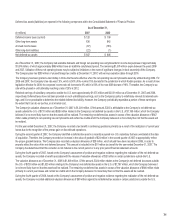

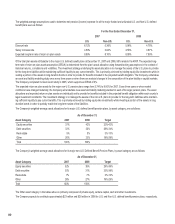

The following pension benefit payments, which reflect expected future service, are expected to be paid:

(in millions) U.S. Non-U.S.

2008 $ 470 $ 257

2009 431 245

2010 431 240

2011 417 236

2012 413 235

2013-2017 2,021 1,152

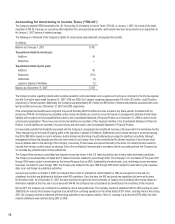

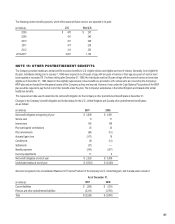

NOTE 19: OTHER POSTRETIREMENT BENEFITS

The Company provides healthcare, dental and life insurance benefits to U.S. eligible retirees and eligible survivors of retirees. Generally, to be eligible for

the plan, individuals retiring prior to January 1, 1996 were required to be 55 years of age with ten years of service or their age plus years of service must

have equaled or exceeded 75. For those retiring after December 31, 1995, the individuals must be 55 years of age with ten years of service or have been

eligible as of December 31, 1995. Based on the eligibility requirements, these benefits are provided to U.S. retirees who are covered by the Company’s

KRIP plan and are funded from the general assets of the Company as they are incurred. However, those under the Cash Balance Plus portion of the KRIP

plan would be required to pay the full cost of their benefits under the plan. The Company’s subsidiaries in the United Kingdom and Canada offer similar

healthcare benefits.

The measurement date used to determine the net benefit obligation for the Company’s other postretirement benefit plans is December 31.

Changes in the Company’s benefit obligation and funded status for the U.S., United Kingdom and Canada other postretirement benefit plans

are as follows:

(in millions) 2007 2006

Net benefit obligation at beginning of year $ 3,009 $ 3,061

Service cost 8 11

Interest cost 165 166

Plan participants’ contributions 25 23

Plan amendments (88) (15)

Actuarial (gain) loss (317) 18

Curtailments (9) (14)

Settlements (37) —

Benefit payments (243) (247)

Currency adjustments 11 6

Net benefit obligation at end of year $ 2,524 $ 3,009

Underfunded status at end of year $ (2,524) $ (3,009)

Amounts recognized in the Consolidated Statement of Financial Position for the Company’s U.S., United Kingdom, and Canada plans consist of:

As of December 31,

(in millions) 2007 2006

Current liabilities $ (209) $ (253)

Pension and other postretirement liabilities (2,315) (2,756)

Total $ (2,524) $ (3,009)