Kodak 2007 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

• Increase the Audit Chair retainer from $15,000 to $20,000 per year.

• Eliminate the following director benefits and perquisites: life insurance, travel/accident insurance and personal liability insurance.

• Maintain the chair retainer of the Committee Chairs at $10,000 per year, with the exception of the Audit chair.

• Maintain the Presiding Director’s retainer at $100,000 per year.

The changes to the equity retainer became effective on December 11, 2007. The remaining changes became effective as of January 1,

2008.

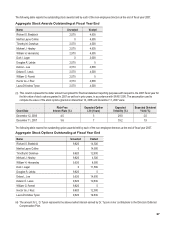

As a result of these changes, the annual cash and equity components of the Company’s director compensation program are now as

follows:

Cash Equity

Board Retainer

(1)

Chair/Presiding

Director Retainer

(2)

Restricted Stock

(3)

Stock Options

(4) Total

Director $70,000 — $70,000 $70,000 $210,000

Presiding Director 70,000 $100,000 70,000 70,000 310,000

Audit Committee Chair 70,000 20,000 70,000 70,000 230,000

Compensation Committee Chair 70,000 10,000 70,000 70,000 220,000

Finance Committee Chair 70,000 10,000 70,000 70,000 220,000

Governance Committee Chair 70,000 10,000 70,000 70,000 220,000

(1) Directors can elect to have their cash Board retainer paid in stock or deferred into the Directors Deferred Compensation Plan.

(2) The Committee Chairs and the Presiding Director may elect to have their retainers paid in stock or deferred into the Directors Deferred

Compensation Plan.

(3) The restricted shares vest on the first anniversary of the date of grant. Directors who stop serving on the Board prior to vesting, forfeit

their restricted shares, unless their cessation of service is due to retirement, approved reason or death, in which case the restrictions

on the shares lapse on the date of the director’s cessation of service. Directors may elect to defer their restricted shares into the

Directors Deferred Compensation Plan.

(4) The exercise price of the options is the mean between the high and low price of our common stock on the date of grant. The options

become exercisable on the first anniversary of the date of grant and expire seven years after grant. Directors who stop serving on the

Board prior to vesting forfeit their unvested options, unless their cessation of service is due to retirement, approved reason or death. In

the case of retirement and cessation for approved reason, the options continue to vest per their terms and remain exercisable for the

remainder of the option’s full term. In the case of death, the options fully vest upon death and remain exercisable by the directors’

estate for the remainder of the option’s full term.

Director Share Ownership Requirements

A director is not permitted to exercise any stock options or sell any restricted shares granted to him or her by the Company unless and until

the director owns shares of stock in the Company (either outright or through phantom stock units in the Directors Deferred Compensation

Plan) that have a value equal to at least five times the then maximum amount of the annual retainer, which may be taken in cash by the

director (currently, this amount is $350,000).