Kodak 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

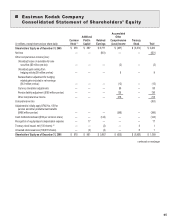

The table below discloses the impact of adoption on the Consolidated Statement of Financial Position as of December 31, 2006.

(in millions)

Before

Application of

SFAS No. 158

Adjustments

Increase/

(Decrease)

After

Application of

SFAS No. 158

Other long-term assets $ 3,205 $ 304 $ 3,509

Total assets 14,016 304 14,320

Accounts payable and other current liabilities 3,669 43 3,712

Total current liabilities 4,511 43 4,554

Pension and other postretirement liabilities 3,288 646 3,934

Other long-term liabilities 1,689 1 1,690

Total liabilities 12,242 690 12,932

Accumulated other comprehensive loss (249) 386 (635)

Total shareholders’ equity 1,774 (386) 1,388

Total liabilities and shareholders’ equity $ 14,016 $ 304 $ 14,320

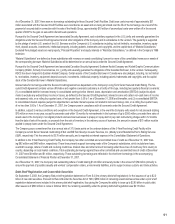

FASB Statement No. 155

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments (an amendment of FASB Statements No. 133

and 140).” This Statement permits fair value measurement for any hybrid financial instrument that contains an embedded derivative that otherwise would

require bifurcation. SFAS No. 155 is effective for all financial instruments acquired, issued, or subject to a remeasurement event occurring after the begin-

ning of an entity’s first fiscal year that begins after September 15, 2006 (year ending December 31, 2007 for the Company). Additionally, the fair value

option may also be applied upon adoption of this Statement for hybrid financial instruments that had been bifurcated under previous accounting guid-

ance prior to the adoption of this Statement. The adoption of SFAS No. 155 in the first quarter of 2007 did not have a material impact on the Company’s

Consolidated Financial Statements.

FASB Interpretation No. 48

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 clarifies the accounting and

reporting for uncertainty in income taxes recognized in accordance with SFAS No. 109, “Accounting for Income Taxes.” This Interpretation prescribes a

recognition threshold and measurement attribute for financial statement recognition and measurement of a tax position taken or expected to be taken in a

tax return, and also provides guidance on various related matters such as derecognition, interest and penalties, and disclosure. The adoption of FIN 48 in

the first quarter of 2007 did not have a material impact on the Company’s Consolidated Financial Statements. Further information regarding the adoption

of FIN 48 is disclosed in Note 16, “Income Taxes.”

FASB Statement No. 157

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which establishes a comprehensive framework for measuring fair value

and expands disclosures about fair value measurements. Specifically, this Statement sets forth a definition of fair value, and establishes a hierarchy

prioritizing the inputs to valuation techniques, giving the highest priority to quoted prices in active markets for identical assets and liabilities and the lowest

priority to unobservable inputs. This Statement, as modified by FASB Staff Position (FSP) 157-2, is effective for fiscal years beginning after November 15,

2007 (January 1, 2008 for the Company) for financial assets and liabilities, and fiscal years beginning after November 15, 2008 (January 1, 2009 for the

Company) for nonfinancial assets and liabilities. The provisions of SFAS No. 157 are generally required to be applied on a prospective basis, except to

certain financial instruments accounted for under SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” for which the provisions of

SFAS No. 157 should be applied retrospectively. The Company is currently evaluating the potential impact, if any, of the adoption of SFAS No. 157 on its

Consolidated Financial Statements.

FASB Statement No. 159

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities,” which permits entities to choose

to measure, on an item-by-item basis, specified financial instruments and certain other items at fair value. Unrealized gains and losses on items for which

the fair value option has been elected are required to be reported in earnings at each reporting date. SFAS No. 159 is effective for fiscal years beginning

after November 15, 2007 (January 1, 2008 for the Company). The provisions of this statement are required to be applied prospectively. The Company will

adopt SFAS No. 159 in the first quarter of 2008, and the adoption will not have a material impact on its Consolidated Financial Statements.