Kodak 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

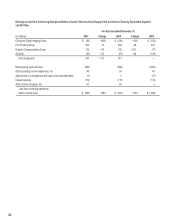

25

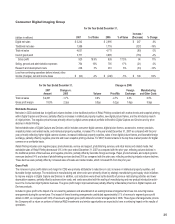

Consumer Digital Imaging Group

(dollars in millions)

For the Year Ended December 31,

2007

% of Sales

2006

% of Sales

Increase /

(Decrease)

% Change

Digital net sales $ 3,242 $ 2,995 $ 247 8%

Traditional net sales 1,389 1,716 (327) -19%

Total net sales 4,631 4,711 (80) -2%

Cost of goods sold 3,711 3,885 (174) -4%

Gross profit 920 19.9% 826 17.5% 94 11%

Selling, general and administrative expenses 764 16% 785 17% (21) -3%

Research and development costs 248 5% 281 6% (33) -12%

Loss from continuing operations before interest, other

income (charges), net and income taxes

$ (92)

-2%

$ (240)

-5%

$ 148

62%

For the Year Ended December 31, Change vs. 2006

2007

Amount

Change vs.

2006

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other Costs

Total net sales $ 4,631 -1.7% 0.6% -4.7% 2.4% 0.0%

Gross profit margin 19.9% 2.3pp 0.0pp -5.2pp 1.6pp 5.9pp

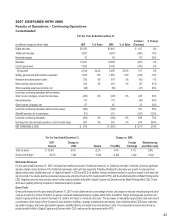

Worldwide Revenues

Net sales in CDG declined due to significant volume declines in the traditional portion of Retail Printing consistent with market trends and snapshot printing

within Digital Capture and Devices, partially offset by increases in intellectual property royalties, new digital picture frames, and the introductory launch

of inkjet printers. The negative price/mix was primarily driven by digital camera product portfolio shifts within Digital Capture and Devices and by price

declines in Retail Printing.

Net worldwide sales of Digital Capture and Devices, which includes consumer digital cameras, digital picture frames, accessories, memory products,

snapshot printers and related media, and intellectual property royalties, increased 7% in the year ended December 31, 2007 as compared with the prior

year, primarily reflecting higher digital camera volumes, increased intellectual property royalties, sales of new digital picture frames, and favorable foreign

exchange, partially offset by negative price/mix and lower snapshot printing volumes. For 2007, Kodak remains in the top three market position for digital

cameras on a worldwide basis.

Retail Printing includes color negative paper, photochemicals, service and support, photofinishing services, and retail kiosks and related media. Net

worldwide sales of Retail Printing decreased 13% in the year ended December 31, 2007 as compared with the prior year, reflecting volume declines in

the traditional portion of the business, and negative price/mix, partially offset by favorable foreign exchange. Paper, photochemicals, and output systems

revenues declined 14% and sales of photofinishing services declined 35% as compared with the prior year, reflecting continuing industry volume declines.

These declines were partially offset by increased sales of kiosks and related media, which increased 8% from the prior year.

Gross Profit

The increase in gross profit dollars and margin for CDG was primarily attributable to reductions in cost, increases in intellectual property royalties, and

favorable foreign exchange. The reductions in manufacturing and other costs were primarily driven by strategic manufacturing and supply chain initiatives

to improve margins in Digital Capture and Devices. In addition, cost reductions were driven by the benefits of previous restructuring activities and lower

depreciation expense, partially offset by adverse silver costs, and costs associated with the scaling of manufacturing and new product introduction activi-

ties in the Consumer Inkjet Systems business. The gross profit margin improvement was partially offset by unfavorable price/mix in Digital Capture and

Devices products.

Included in gross profit is the impact of a non-recurring extension and amendment of an existing license arrangement and new non-recurring license

arrangements during the current year. The impact of these licensing arrangements contributed approximately 5.1% of revenue to segment gross profit

dollars in 2007, as compared with 3.8% of revenue to segment gross profit dollars for similar arrangements in 2006. These types of arrangements provide

the Company with a return on portions of historical R&D investments and similar opportunities are expected to have a continuing impact on the results of

operations.