Kodak 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

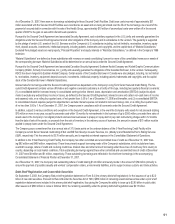

67

of the Subsidiary, only to the extent it becomes necessary to do so, to (1) make contributions to the Plan to ensure sufficient assets exist to make plan

benefit payments, and (2) make contributions to the Plan such that it will achieve full funded status by the funding valuation for the period ending Decem-

ber 31, 2015. The guarantee expires upon the conclusion of the funding valuation for the period ending December 31, 2015 whereby the Plan achieves full

funded status or earlier, in the event that the Plan achieves full funded status for two consecutive funding valuation cycles which are typically performed at

least every three years.

The limit of potential future payments is dependent on the funding status of the Plan as it fluctuates over the term of the guarantee. However, as of

December 31, 2007 management believes that performance under this guarantee by Eastman Kodak Company is unlikely. The funding status of the Plan

is included in Pension and other postretirement liabilities presented in the Consolidated Statement of Financial Position.

Indemnications

The Company issues indemnifications in certain instances when it sells businesses and real estate, and in the ordinary course of business with its

customers, suppliers, service providers and business partners. Further, the Company indemnifies its directors and officers who are, or were, serving

at the Company’s request in such capacities. Historically, costs incurred to settle claims related to these indemnifications have not been material to the

Company’s financial position, results of operations or cash flows. Additionally, the fair value of the indemnifications that the Company issued during the

year ended December 31, 2007 was not material to the Company’s financial position, results of operations or cash flows.

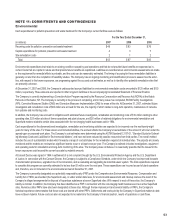

Warranty Costs

The Company has warranty obligations in connection with the sale of its products and equipment. The original warranty period for equipment products

is generally one year or less. The costs incurred to provide for these warranty obligations are estimated and recorded as an accrued liability at the time

of sale. The Company estimates its warranty cost at the point of sale for a given product based on historical failure rates and related costs to repair. The

change in the Company’s accrued warranty obligations balance, which is reflected in accounts payable and other current liabilities in the accompanying

Consolidated Statement of Financial Position, was as follows:

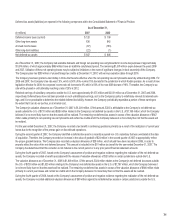

(in millions)

Accrued warranty obligations as of December 31, 2005 $ 35

Actual warranty experience during 2006 (48)

2006 warranty provisions 52

Accrued warranty obligations as of December 31, 2006 $ 39

Actual warranty experience during 2007 (46)

2007 warranty provisions 51

Accrued warranty obligations as of December 31, 2007 $ 44

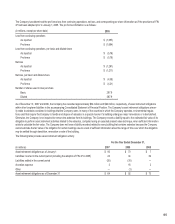

The Company also offers its customers extended warranty arrangements that are generally one year, but may range from three months to three years

after the original warranty period. The Company provides repair services and routine maintenance under these arrangements. The Company has not

separated the extended warranty revenues and costs from the routine maintenance service revenues and costs, as it is not practicable to do so. There-

fore, these revenues and costs have been aggregated in the presentation below. The change in the Company’s deferred revenue balance in relation to

these routine maintenance and extended warranty arrangements, which is reflected in accounts payable and other current liabilities in the accompanying

Consolidated Statement of Financial Position, was as follows:

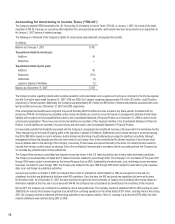

(in millions)

Deferred revenue as of December 31, 2005 $ 138

New extended warranty and maintenance arrangements in 2006 371

Recognition of extended warranty and maintenance arrangement revenue in 2006 (366)

Deferred revenue as of December 31, 2006 $ 143

New extended warranty and maintenance arrangements in 2007 396

Recognition of extended warranty and maintenance arrangement revenue in 2007 (391)

Deferred revenue as of December 31, 2007 $ 148

Costs incurred under these extended warranty and maintenance arrangements for the years ended December 31, 2007 and 2006 amounted to $180

million and $177 million, respectively.