Burger King 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

The Senior Notes are guaranteed by BKH and all existing direct and indirect subsidiaries that borrow under or guarantee any indebtedness or indebtedness

of another guarantor. Under certain circumstances, subsidiary guarantors may be released from their guarantees without the consent of the holders of the Senior

Notes.

At any time prior to October 15, 2013, we may redeem up to 35% of the original principal amount of the Senior Notes with the proceeds of certain equity

offerings at a redemption price equal to 109.875% of the principal amount of the Senior Notes, together with any accrued and unpaid interest, if any, to the date

of redemption. The Senior Notes are redeemable at our option, in whole or in part, at any time on or after October 15, 2014 at 104.938% of the principal amount,

at any time on or after October 15, 2015 at 102.469% of the principal amount or at any time on or after October 15, 2016 at 100% of the principal amount.

The occurrence of a change in control will require us to offer to purchase all or a portion of the Senior Notes at a price equal to 101% of the principal

amount, together with accrued and unpaid interest, if any, to the date of purchase. Certain asset dispositions will also require us to use the proceeds from those

asset dispositions to make an offer to purchase the Senior Notes at 100% of their principal amount, if such proceeds are not otherwise used within a specified

period to repay indebtedness or to invest in capital assets related to our business or capital stock of a restricted subsidiary.

The Senior Notes were issued pursuant to an indenture (the “Senior Notes Indenture”), which contains certain covenants that we must meet during the term

of the Senior Notes, including, but not limited to, limitations on restricted payments (as defined in the Senior Notes Indenture), incurrence of indebtedness,

issuance of disqualified stock and preferred stock, asset sales, mergers and consolidations, transactions with affiliates, guarantees of indebtedness by subsidiaries

and activities of BKH.

The Senior Notes Indenture also includes customary events of default including, but not limited to, nonpayment of principal, interest, premiums or other

amounts due under the Senior Notes Indenture, violation of a covenant, cross-default to material indebtedness, bankruptcy and a change of control. Failure to

comply with the covenants or other provision of the Senior Notes Indenture (subject to grace periods) could, absent a waiver or an amendment from the lenders

under such Senior Notes Indenture, permit the acceleration of all outstanding borrowings under such credit agreement.

At December 31, 2011, we were in compliance with all covenants of the Senior Notes Indenture.

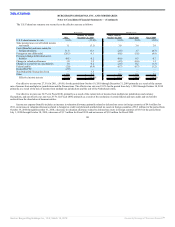

Loss on Early Extinguishment of Debt

In connection with the amendment of our Credit Facility in February 2011, we recorded a $19.6 million loss on early extinguishment of debt. We recorded

an additional $1.8 million loss on early extinguishment of debt in connection with the Term Loan prepayments and Senior Note repurchases described above in

2011. Loss on early extinguishment of debt consists principally of write-offs of deferred financing costs and original issue discount.

94

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠