Burger King 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

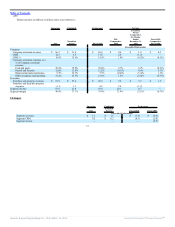

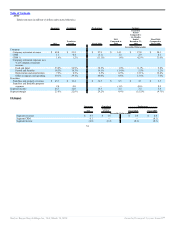

Key Business Metrics

Successor Combined Predecessor

2011

Transition

Period Fiscal 2010 Fiscal 2009

Systemwide sales growth 13.5% 18.6% 4.8% 8.5%

Comparable sales growth

Company 4.3% (3.1)% (4.1)% (3.2)%

Franchise 8.1% 6.8% (1.1)% 2.3%

System 7.9% 6.2% (1.3)% 1.9%

NRG

Company 1 2 5 8

Franchise 81 33 55 68

System 82 35 60 76

Net Refranchisings (trailing twelve months) — — — —

Restaurant counts at period end

Company 97 96 97 92

Franchise 1,125 1,044 1,041 986

System 1,222 1,140 1,138 1,078

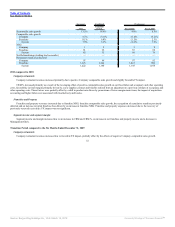

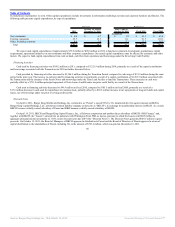

2011 compared to 2010

Company restaurants

Company restaurant revenues increased primarily due to positive Company comparable sales growth and slightly favorable FX impact.

CRM % increased primarily as a result of the leveraging effect of positive comparable sales growth on our fixed labor and occupancy and other operating

costs, favorability in food margins primarily driven by a new supplier contract and benefits realized from an adjustment to a previous estimate of occupancy and

other operating costs. These factors were partially offset by a shift in product mix driven by promotions of lower margin menu items, the impact of acquisition

accounting and higher labor costs associated with food delivery and kiosks.

Franchise and Property

Franchise and property revenues increased due to franchise NRG, franchise comparable sales growth, the recognition of cumulative royalties previously

deferred and an increase in initial franchise fees driven by an increase in franchise NRG. Franchise and property expenses decreased due to the recovery of

previously reserved receivables. FX impact was not significant.

Segment income and segment margin

Segment income and margin increased due to an increase in CRM and CRM %, an increase in net franchise and property income and a decrease in

Management G&A.

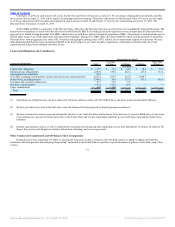

Transition Period compared to the Six Months Ended December 31, 2009

Company restaurants

Company restaurant revenues increased due to favorable FX impact, partially offset by the effects of negative Company comparable sales growth.

52

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠