Burger King 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

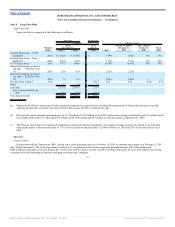

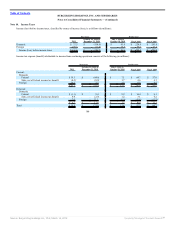

Rent expense associated with the lease commitments is as follows (in millions):

Successor Predecessor

2011

October 19, 2010 to

December 31, 2010

July 1, 2010 to

October 18, 2010

Fiscal 2010 Fiscal 2009

Rental expense:

Minimum $ 167.3 $ 27.8 $ 47.4 $ 168.9 $ 166.5

Contingent 4.5 1.3 2.0 7.4 7.7

Amortization of favorable and unfavorable

payable lease contracts, net (3.4) (0.9) (3.9) (15.0) (18.2)

Total rental expense $ 168.4 $ 28.2 $ 45.5 $ 161.3 $ 156.0

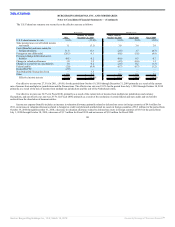

The impact of favorable and unfavorable lease amortization on operating income is as follows (in millions):

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1, 2010 to

October 18,

2010

Fiscal 2010 Fiscal 2009

Franchise and property revenues $ 6.6 $ 1.3 $ — $ — $ —

Company restaurant expenses:

Occupancy and other operating costs 4.1 1.0 2.6 10.4 12.7

Franchise and property expenses (0.7) (0.1) 1.3 4.6 5.5

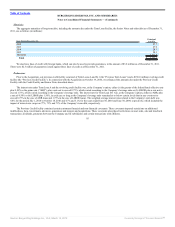

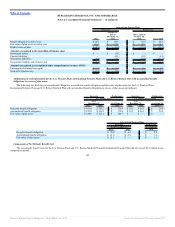

Estimated future amortization expense (benefit) of favorable and unfavorable lease contracts subject to amortization are as follows (in millions):

Company Restaurants

Occupancy and Other Operating

Expenses Franchise and Property Revenue Franchise and Property Expenses

Favorable Unfavorable Favorable Unfavorable Favorable Unfavorable

2012 $ 7.0 $ (10.2) $ 4.8 $ (11.2) $ 5.6 $ (4.9)

2013 6.8 (9.7) 4.4 (10.6) 5.5 (4.7)

2014 6.5 (8.7) 3.9 (10.1) 5.4 (4.1)

2015 5.9 (7.4) 3.4 (9.7) 5.2 (3.5)

2016 5.5 (6.6) 3.1 (9.3) 5.0 (3.2)

Thereafter 28.8 (27.3) 15.4 (46.9) 30.0 (16.1)

Total $ 60.5 $ (69.9) $ 35.0 $ (97.8) $ 56.7 $ (36.5)

99

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠