Burger King 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

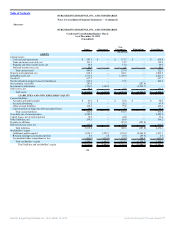

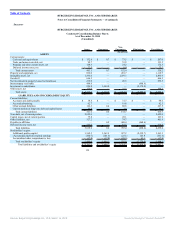

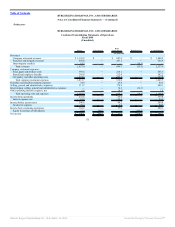

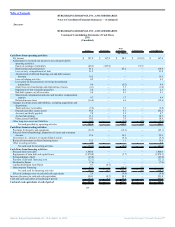

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

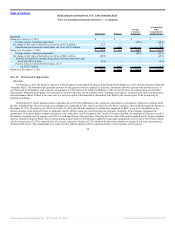

Long-lived assets include property and equipment, net, and net investment in property leased to franchisees. Only the United States represented 10% or

more of our total long-lived assets as of December 31, 2011 and 2010 and June 30, 2010. Long-lived assets in the United States, including the unallocated

portion, totaled $1,069.3 million as of December 31, 2011, $1,127.0 million as of December 31, 2010 and $923.2 million as of June 30, 2010. Refer to Note 1 for

the impact of acquisition accounting adjustments.

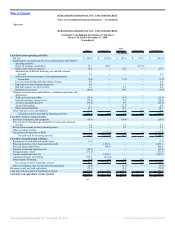

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010 Fiscal 2010 Fiscal 2009

Capital Expenditures:

United States and Canada $ 56.5 $ 17.4 $ 11.0 $ 99.9 $ 146.9

EMEA 11.1 3.3 0.9 22.9 25.7

LAC 1.8 1.1 0.3 5.4 7.6

APAC 3.8 2.1 2.3 8.0 5.0

Unallocated 8.9 4.5 3.7 14.1 18.8

Total capital expenditures $ 82.1 $ 28.4 $ 18.2 $ 150.3 $ 204.0

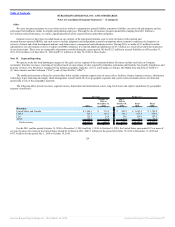

Note 20. Supplemental Financial Information

On October 19, 2010, BKC issued $800 million of 9 7/8% Senior Notes due 2018. These Notes are irrevocably and unconditionally guaranteed, jointly and

severally, on a senior unsecured basis by us and the U.S. subsidiaries of BKC (the “Guarantors”).

The following represent the condensed consolidating financial information for the Issuer, the Guarantors and the non-U.S. subsidiaries of BKC (the

“Non-Guarantors”), together with eliminations, as of and for the periods indicated. The consolidating financial information may not necessarily be indicative of

the financial position, results of operations or cash flows had BKC, Guarantors and Non-Guarantors operated as independent entities.

127

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠