Burger King 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

requirements in the U.S. and to the degree cash is transferred to the U.S. from our foreign subsidiaries, we expect we will be able to do so in a tax efficient

manner. However, adverse income tax consequences could result if we are compelled to make unplanned transfers of cash to meet future liquidity requirements

in the U.S.

As a result of the Transactions, we are highly leveraged. Our liquidity requirements are significant, primarily due to debt service requirements.

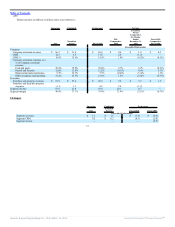

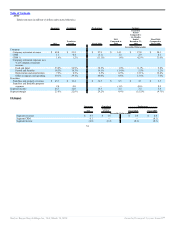

Debt Instruments and Debt Service Requirements

Our long-term debt is comprised primarily of borrowings under our Credit Agreement, amounts outstanding under our Senior Notes and obligations under

capital leases. The following information summarizes the principal terms and near term debt service requirements under our Credit Agreement and the indenture

governing our Senior Notes (the “Senior Notes Indenture”). For further information about our long-term debt, see Note 8 to the accompanying audited

Consolidated Financial Statements included in Part II, Item 8 “Financial Statements and Supplementary Data”.

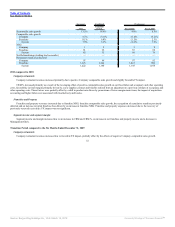

Credit Agreement

In connection with the Transactions, BKC entered into a credit agreement dated as of October 19, 2010, as amended and restated as of February 15, 2011

(the “Credit Agreement”). The Credit Agreement provides for (i) two tranches of term loans in an aggregate principal amount of $1,600.0 million and

€200.0 million, respectively, each under a term loan facility (the “Term Loan Facility”) and (ii) a senior secured revolving credit facility for up to $150 million of

revolving extensions of credit outstanding at any time (including revolving loans, swingline loans and letters of credit) (the “Revolving Credit Facility,” and

together with the Term Loan Facility, the “Credit Facilities”). The maturity date for the Term Loan Facility is October 19, 2016 and the maturity date for the

Revolving Credit Facility is October 19, 2015.

As of December 31, 2011, we had no amounts outstanding under the Revolving Credit Facility although we utilized approximately $14.5 million of the

available commitment as of December 31, 2011 to support letters of credit, leaving $135.5 million of borrowing capacity available. We may, from time to time,

borrow from and repay the Revolving Credit Facility. Consequently, the amount outstanding under the Revolving Credit Facility at the end of a period may not

be reflective of the total amounts outstanding during the period.

Based on the amounts outstanding under the Term Loan Facility, as of December 31, 2011, required debt service for the next twelve months will be

approximately $81.7 million in interest and $18.6 million in principal payments. Additionally, following the end of each fiscal year, we are required to prepay the

Term Loans in an amount equal to 50% of Excess Cash Flow (as defined in the Credit Agreement and with stepdowns to 25% and 0% based on achievement of

specified total leverage ratios), minus the amount of any voluntary prepayments of the Term Loans during such fiscal year.

We may prepay the term loans in whole or in part at any time. A 1% premium applies if the prepayment is made in connection with an interest rate

re-pricing event. During 2011, we made voluntary prepayments of $60.5 million of our Term Loans and, as a result, were not required to make a mandatory

prepayment based on Excess Cash Flow as described above. We may make additional voluntary prepayments of our Term Loans in the future subject to our

liquidity requirements.

Under the Credit Agreement, at BKC’s election, the interest rate per annum applicable to the loans is based on a fluctuating rate of interest determined by

reference to either a base rate or a Eurocurrency rate, as more fully described in Note 8 to our audited Consolidated Financial Statements. We entered into

deferred premium interest rate cap agreements, which effectively cap the annual interest expense applicable to our borrowings under the Credit Agreement to a

maximum of 4.75% for U.S. Dollar denominated borrowings and 5.0% for our Euro-denominated borrowings.

57

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠