Burger King 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

The net amount of pre-tax gains and losses in accumulated comprehensive income (loss) as of December 31, 2011 that we expect to be reclassified into

earnings within the next 12 months is $3.6 million of losses.

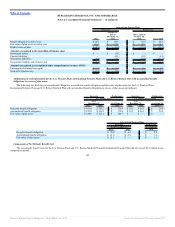

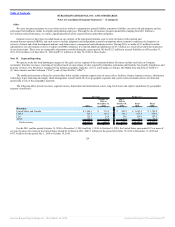

Successor Predecessor

October 19, 2010 to December 31, 2010 July 1, 2010 to October 18, 2010

Interest Rate

Caps

Interest Rate

Swaps

Foreign

Currency

Forward

Contracts Total

Interest Rate

Swaps

Foreign

Currency

Forward

Contracts Total

Derivatives designated as cash flow

hedging instruments:

Gain (loss) recognized in other

comprehensive income (effective

portion) $ 35.8 $ — $ 0.1 $ 35.9 $ (2.4) $ (0.1) $ (2.5)

Gain (loss) reclassified from AOCI into

interest expense, net(1) $ — $ — $ — $ — $ (4.9) $ — $ (4.9)

Derivatives not designated as hedging

instruments:

Gain (loss) recognized in other operating

expense, net $ — $ (0.2) $ 17.2 $ 17.0 $ — $ (42.4) $ (42.4)

(1) Includes $0.4 million of gain for the period of July 1, 2010 to October 18, 2010 related to terminated hedges and zero for the period October 19, 2010 to

December 31, 2010.

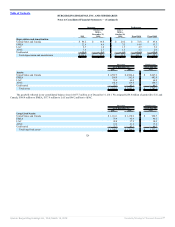

Predecessor

Fiscal 2010

Interest Rate

Swaps

Foreign

Currency

Forward

Contracts Total

Derivatives designated as cash flow hedging instruments:

Gain (loss) recognized in other comprehensive income (effective portion) $ (16.4) $ (0.6) $ (17.0)

Gain (loss) reclassified from AOCI into interest expense, net(1) $ (21.1) $ — $ (21.1)

Gain (loss) reclassified from AOCI into royalty income $ — $ (0.8) $ (0.8)

Gain (loss) recognized in interest expense, net (ineffective portion) $ (0.2) $ — $ (0.2)

Derivatives not designated as hedging instruments:

Gain (loss) recognized in other operating expense, net $ — $ 44.6 $ 44.6

(1) Includes $1.6 million of gain related to the terminated hedges for the fiscal year ended June 30, 2010.

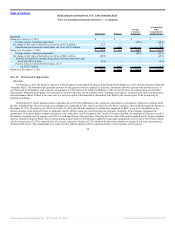

Note 14. Stockholders’ Equity

Dividends Paid

We paid a quarterly cash dividend of $0.0625 per share on September 30, 2010 to the Predecessor’s shareholders of record at the close of business on

September 14, 2010. Total dividends paid by the Predecessor during the period July 1, 2010 to October 18, 2010 were $8.6 million. Total dividends paid to the

Predecessor’s shareholders were $34.2 million in fiscal 2010 and $34.1 million in fiscal 2009.

Although we do not currently have a dividend policy, we may declare dividends periodically if our Board of Directors determines that it is in the best

interests of the shareholders. The terms of the Credit Agreement and the

116

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠