Burger King 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

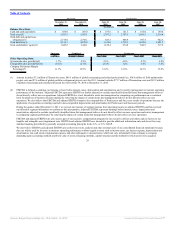

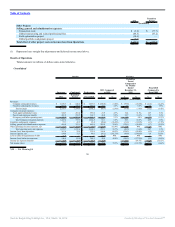

FX Impact

Successor Combined Predecessor

2011

Transition

Period Fiscal 2010 Fiscal 2009

Favorable/(Unfavorable)

Consolidated revenues $ 35.6 $ (17.3) $ 17.4 $ (95.8)

Consolidated CRM 2.6 (1.3) 1.2 (8.0)

Consolidated SG&A (8.2) 6.7 (2.8) 15.2

Consolidated income (loss) from operations 5.3 (1.9) (0.3) (3.5)

Consolidated net income (loss) 5.7 (3.0) (2.2) (1.8)

Consolidated adjusted EBITDA 4.5 (2.5) 1.4 (5.7)

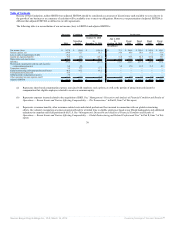

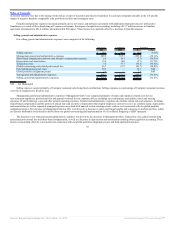

Key Business Metrics

2011

Transition

Period

Fiscal

2010

Fiscal

2009

Systemwide sales growth 1.7% 2.2% 2.1% 4.2%

Comparable sales growth

Company 0.1% (3.8)% (2.4)% 0.3%

Franchise (0.6)% (2.5)% (2.3)% 1.4%

System (0.5)% (2.7)% (2.3)% 1.2%

Average restaurant sales (in thousands) $ 1,248.0 $ 622.0 $ 1,244.0 $ 1,259.0

NRG

Company (4) 4 10 33

Franchise 265 169 239 327

System 261 173 249 360

Net Refranchisings (trailing twelve months) 45 82 52 (36)

Restaurant counts at period end

Company 1,295 1,344 1,387 1,429

Franchise 11,217 10,907 10,787 10,496

System 12,512 12,251 12,174 11,925

CRM % 11.7% 12.9% 12.2% 12.6%

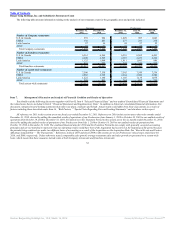

2011 compared to 2010

Company restaurants

Company restaurant revenues decreased due to the net refranchising of 45 Company restaurants, primarily in the U.S. and Canada, partially offset by

favorable FX impact across all segments.

CRM % decreased due to the effects of acquisition accounting, higher commodity prices in the U.S. and Canada and EMEA and a non-recurring $4.7

million favorable adjustment to our self insurance reserve in 2010. These factors were partially offset by improved labor margins due to benefits realized from

improvements in variable labor controls and scheduling in our restaurants as well as changes in U.S. restaurant compensation plans to more closely align

incentive compensation with restaurant performance.

Franchise and Property

Franchise and property revenues consist primarily of royalties earned on franchise sales, franchise fees and rents from real estate leased or subleased to

franchisees. Franchise and property revenues increased primarily due to new leases and subleases associated with the refranchised restaurants, royalties derived

from franchise NRG, favorable FX impact and the impact of acquisition accounting. These factors were partially offset by a decrease

37

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠