Burger King 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

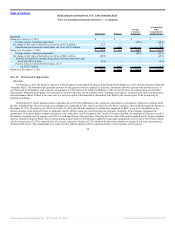

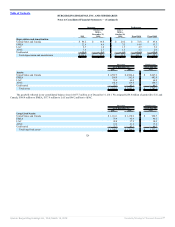

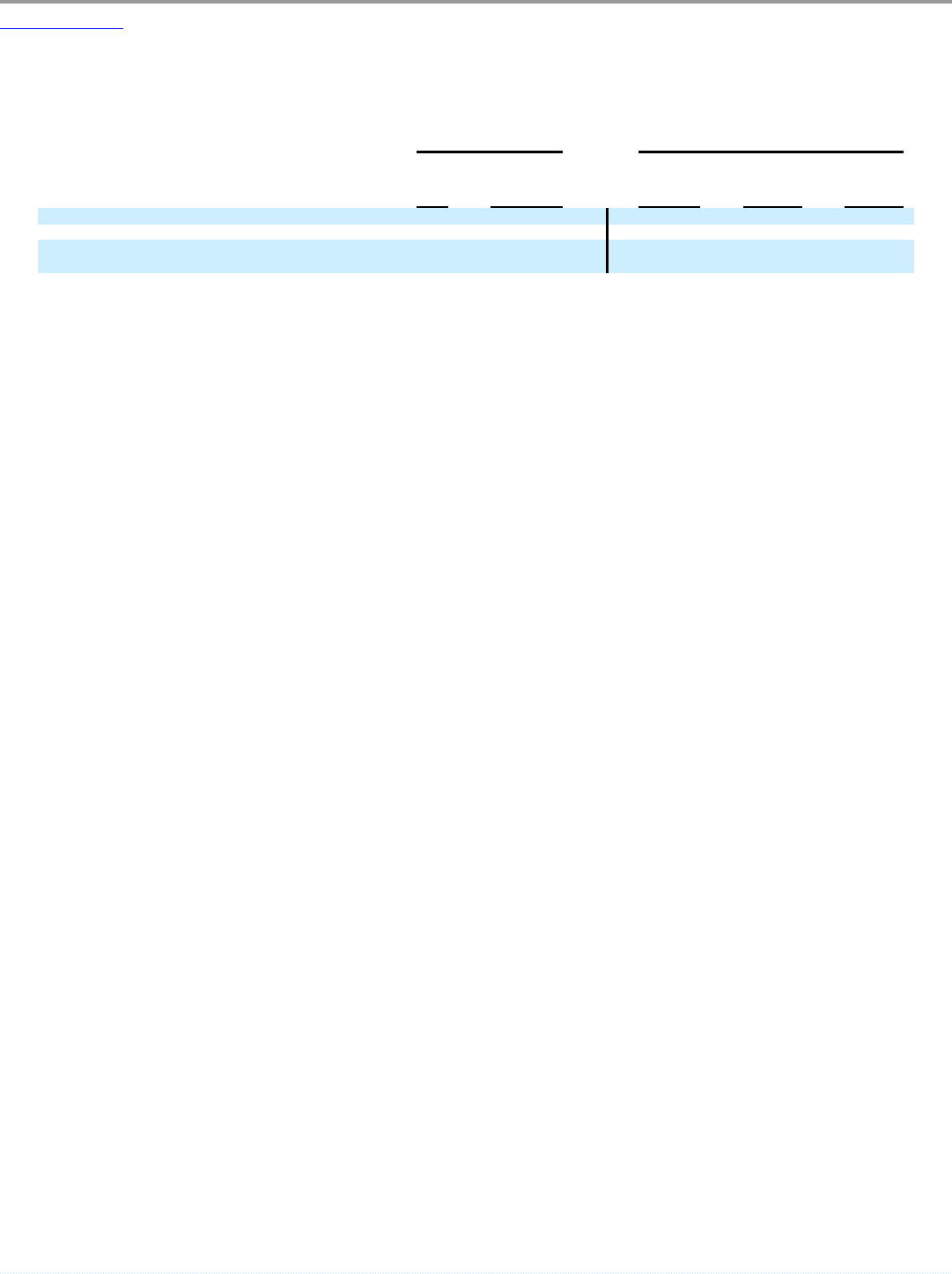

Closures and dispositions are summarized as follows (in millions, except for number of restaurants):

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010 Fiscal 2010 Fiscal 2009

Number of restaurant closures 18 5 8 34 19

Number of refranchisings 47 5 35 91 51

Net losses (gains) on disposal of assets, restaurant closures

and refranchisings $ 6.2 $ 5.8 $ (3.2) $ (2.4) $ (8.5)

Note 18. Commitments and Contingencies

Guarantees

We guarantee certain lease payments of franchisees arising from leases assigned in connection with sales of Company restaurants to franchisees, by

remaining secondarily liable for base and contingent rents under the assigned leases of varying terms. The maximum contingent rent amount is not determinable

as the amount is based on future revenues. In the event of default by the franchisees, we have typically retained the right to acquire possession of the related

restaurants, subject to landlord consent. The aggregate contingent obligation arising from these assigned lease guarantees, excluding contingent rents, was $82.8

million as of December 31, 2011, expiring over an average period of seven years.

From time to time, we enter into agreements under which we guarantee loans made to qualified franchisees. As of December 31, 2011, there were $24.2

million of loans outstanding to franchisees under two such programs, with additional franchisee borrowing capacity of approximately $245.0 million

remaining. Our maximum guarantee liability under these two programs is limited to an aggregate of $24.5 million, assuming full utilization of all borrowing

capacity. As of December 31, 2011, the liability we recorded to reflect the fair value of these guarantee obligations was not significant. No events of default have

occurred and no payments have been made by us in connection with these guarantees through December 31, 2011.

Other commitments arising out of normal business operations were $6.7 million as of December 31, 2011, of which over 99% was guaranteed under bank

guarantee arrangements.

Letters of Credit

As of December 31, 2011, we had $16.8 million in irrevocable standby letters of credit outstanding, which were issued primarily to certain insurance

carriers to guarantee payments of deductibles for various insurance programs, such as health and commercial liability insurance. Of these letters of credit

outstanding, $14.5 million are secured by the collateral under our Revolving Credit Facility. As of December 31, 2011, no amounts had been drawn on any of

these irrevocable standby letters of credit.

As of December 31, 2011, we had posted bonds totaling $3.2 million, which related to certain utility deposits and capital projects.

Vendor Relationships

During the fiscal year ended June 30, 2000, we entered into long-term, exclusive contracts with soft drink vendors to supply Company and franchise

restaurants with their products and obligating Burger King® restaurants in the United States to purchase a specified number of gallons of soft drink syrup. These

volume

122

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠