Burger King 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

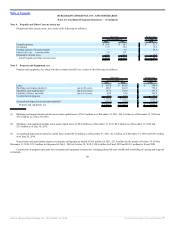

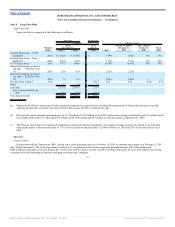

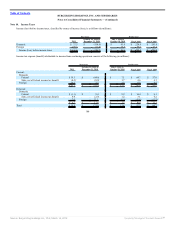

Note 8. Long-Term Debt

Long-Term Debt

Long-term debt is comprised of the following (in millions):

Successor Predecessor

Principal Interest rates(a)

Maturity

dates

As of

December 31,

As of

June 30,

October 19, 2010 to

December 31,

2010

July 1, 2010 to

October 18,

2010

Fiscal

2010

2011 2010 2010 2011

Secured Term Loan — USD

tranche(b) 2016 $ 1,532.0 $ 1,510.0 $ — 5.49% 6.82% N/A N/A

Secured Term Loan — Euro

tranche(b) 2016 247.8 334.2 5.79% 7.11% N/A N/A

9 7/8% Senior Notes 2018 797.5 800.0 — 10.14% 10.19% N/A N/A

Deferred Premiums on interest

rate caps — USD (See Note

13) 2016 35.8 42.4 — 2.52% 2.52% — —

Deferred Premiums on interest

rate caps — EUR (See Note

13) 2016 7.3 11.1 — 2.86% 2.86% — —

Previous Term Loans(c) N/A — — 753.7 N/A N/A 4.4% 4.7%

Other 3.2 1.4 1.7

Total debt 2,623.6 2,699.1 755.4

Less: current maturities of

debt (24.2) (27.0) (87.7)

Total long-term debt $ 2,599.4 $ 2,672.1 $ 667.7

(a) Represents the effective interest rate for the instrument computed on a quarterly basis, including the amortization of deferred debt issuance costs and

original issue discount, and in the case of our Secured Term Loans, the effect of interest rate caps.

(b) Principal face amount herein is presented gross of a 1% discount of $12.5 million on the USD tranche and revolving credit facility and $1.0 million on the

Euro tranche at December 31, 2011 and $16.8 million on the USD tranche and $3.3 million on the Euro tranche at December 31, 2010.

(c) The Previous Term Loans were repaid and terminated in connection with the Transactions. The weighted average interest rates related to our term debt

included the impact of interest rate swaps on 77% of our term debt for the period July 1, 2010 to October 18, 2010 and 73% of our term debt in Fiscal

2010.

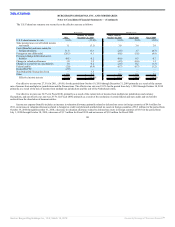

Successor

Credit Facilities

In connection with the Transactions, BKC entered into a credit agreement dated as of October 19, 2010, as amended and restated as of February 15, 2011

(the “Credit Agreement”). The Credit Agreement provides for (i) two tranches of term loans in aggregate principal amounts of $1,600.0 million and

€200.0 million, each under a term loan facility (the “Term Loan Facility”) and (ii) a senior secured revolving credit facility for up to $150 million of revolving

extensions of credit outstanding at any time (including revolving loans, swingline

91

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠