Burger King 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

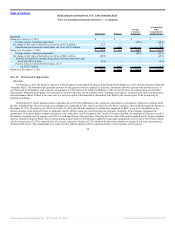

Senior Notes Indenture limit our ability to pay cash dividends in certain circumstances. In addition, because we are a holding company, our ability to pay cash

dividends on shares (including fractional shares) of our common stock may be limited by restrictions on our ability to obtain sufficient funds through dividends

from our subsidiaries, including the restrictions under the Credit Agreement and the Senior Notes Indenture. Subject to the foregoing, the payment of cash

dividends in the future, if any, will be at the discretion of our Board of Directors and will depend upon such factors as earnings levels, capital requirements, our

overall financial condition and any other factors deemed relevant by our Board of Directors. During 2011, we made a dividend totaling $7.6 million to Burger

King Capital Holdings, LLC.

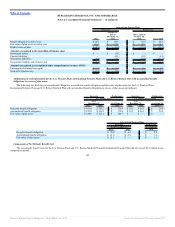

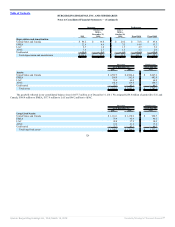

Accumulated Other Comprehensive Income (Loss)

The following table displays the change in the components of accumulated other comprehensive income (loss) (in millions):

Derivatives Pensions

Foreign

Currency

Translation

Accumulated

Other

Comprehensive

Income (Loss)

Predecessor

Balances at June 30, 2008 $ (0.1) $ (2.0) $ (6.3) $ (8.4)

Foreign currency translation adjustment — — (6.0) (6.0)

Net change in fair value of derivatives, net of tax of $10.6 million (16.8) — — (16.8)

Amounts reclassified to earnings during the period from terminated

swaps, net of tax of $0.4 million (0.9) — — (0.9)

Pension and post-retirement benefit plans, net of tax of $9.2 million — (13.8) — (13.8)

Balances at June 30, 2009 (17.8) (15.8) (12.3) (45.9)

Foreign currency translation adjustment — — (4.4) (4.4)

Net change in fair value of derivatives, net of tax of $2.6 million 4.1 — — 4.1

Amounts reclassified to earnings during the period from terminated

swaps, net of tax of $0.6 million (1.0) — — (1.0)

Pension and post-retirement benefit plans, net of tax of $11.3 million — (19.7) — (19.7)

Balances at June 30, 2010 $ (14.7) $ (35.5) $ (16.7) $ (66.9)

Foreign currency translation adjustment — — 13.3 13.3

Net change in fair value of derivatives, net of tax of $1.1 million 1.7 — — 1.7

Amounts reclassified to earnings during the period from terminated

swaps, net of tax of $0.2 million (0.2) — — (0.2)

Pension and post-retirement benefit plans, net of tax of $3.1 million — 5.8 — 5.8

Balances at October 18, 2010 $ (13.2) $ (29.7) $ (3.4) $ (46.3)

117

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠