Burger King 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2011

Transition

Period

(In millions)

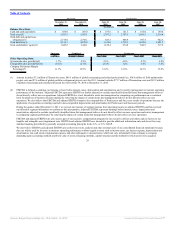

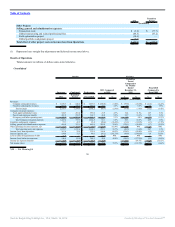

Other Projects

Selling, general and administrative expenses:

Transaction costs $ (3.2) $ (77.7)

Global restructuring and related professional fees (46.5) (67.2)

Field optimization project (10.6) —

Global portfolio realignment project (7.6) —

Total effect of other project costs on income (loss) from Operations $ (67.9) $ (144.9)

(1) Represents lease straight-line adjustments and deferred income noted above.

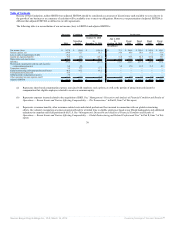

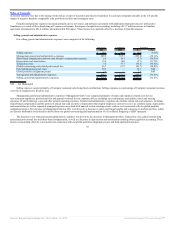

Results of Operations

Tabular amounts in millions of dollars unless noted otherwise.

Consolidated

Results Variance

Successor Combined Predecessor

2011 Compared

to 2010

Transition

Period

Compared to

Six Months

Ended

December 31,

2009

Fiscal 2010

Compared to

Fiscal 2009

2011

Transition

Period Fiscal 2010 $ % $ % $ %

Favorable / (Unfavorable)

Revenues:

Company restaurant revenues $ 1,638.7 $ 846.2 $ 1,839.3 $ (100.8) (5.8)% $ (99.8) (10.5)% $ (41.2) (2.2)%

Franchise and property revenues 697.0 338.3 662.9 32.1 4.8% 2.0 0.6% 6.0 0.9%

Total revenues 2,335.7 1,184.5 2,502.2 (68.7) (2.9)% (97.8) (7.6)% (35.2) (1.4)%

Company restaurant expenses:

Food, paper and product costs 524.7 265.4 585.0 25.9 4.7% 34.4 11.5% 18.7 3.1%

Payroll and employee benefits 481.2 252.5 568.7 48.8 9.2% 38.7 13.3% 13.5 2.3%

Occupancy and other operating costs 441.5 219.4 461.1 10.4 2.3% 9.2 4.0% (3.3) (0.7)%

Total Company restaurant expenses 1,447.4 737.3 1,614.8 85.1 5.6% 82.3 10.0% 28.9 1.8%

Franchise and property expenses 97.1 43.5 65.4 (20.6) (26.9)% (11.1) (34.3)% (1.1) (1.7)%

Selling, general and administrative expenses 416.9 383.1 489.8 202.0 32.6% (129.1) (50.8)% (1.7) (0.3)%

Other operating (income) expenses, net 11.3 (12.3) (0.7) (29.4) 162.4% 17.4 NM 2.6 NM

Total operating costs and expenses 1,972.7 1,151.6 2,169.3 237.1 10.7% (40.5) (3.6)% 28.7 1.3%

Income (loss) from operations 363.0 32.9 332.9 168.4 86.5% (138.3) (80.8)% (6.5) (1.9)%

Interest expense, net 194.8 72.7 48.6 (98.2) (101.7)% (48.0) (194.3)% 6.0 11.0%

Loss on early extinguishment of debt 21.4 — — (21.4) NM — NM — NM

Income (loss) before income taxes 146.8 (39.8) 284.3 48.8 49.8% (186.3) (127.2)% (0.5) (0.2)%

Income tax expense (benefit) 39.8 (9.3) 97.5 (1.4) 59.0 118.7% (12.8) (15.1)%

Net income (loss) $ 107.0 $ (30.5) $ 186.8 $ 47.4 79.5% $ (127.3) (131.5)% $ (13.3) (6.6)%

NM — Not Meaningful

36

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠