Burger King 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

accompanying consolidated balance sheets. At each cap maturity date, the portion of fair value attributable to the matured cap will be reclassified from AOCI

into earnings as a component of interest expense.

Interest Rate Swaps

In connection with the Transactions, interest rate swaps with a notional value of $500 million were terminated. The remaining interest rate swaps that were

not terminated by counterparties had a notional value of $75 million and expired on September 30, 2011.

Foreign Currency Forward Contracts

From time to time, we enter into foreign currency forward contracts to economically hedge the remeasurement of certain foreign currency-denominated

intercompany loans receivable and other foreign-currency denominated assets recorded in our consolidated balance sheets. At December 31, 2011, we had no

foreign currency forward contracts outstanding.

Credit Risk

By entering into derivative instrument contracts, we are exposed to counterparty credit risk. Counterparty credit risk is the failure of the counterparty to

perform under the terms of the derivative contract. When the fair value of a derivative contract is in an asset position, the counterparty has a liability to us, which

creates credit risk for us. We attempt to minimize this risk by selecting counterparties with investment grade credit ratings and regularly monitoring our market

position with each counterparty.

Credit-Risk Related Contingent Features

Our derivative instruments do not contain any credit-risk related contingent features.

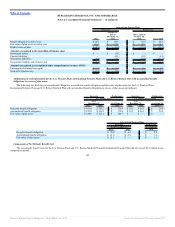

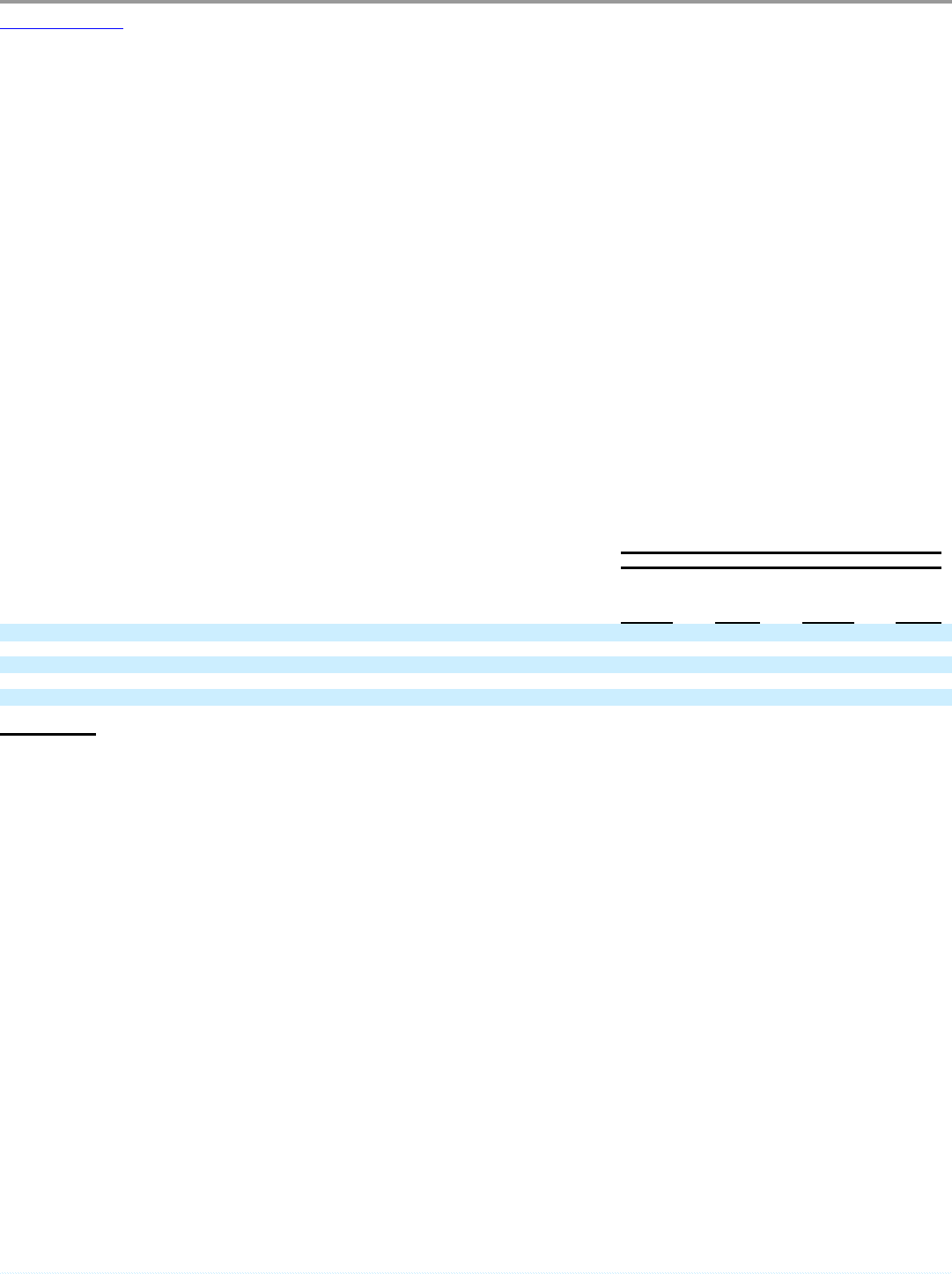

The following tables present the required quantitative disclosures for our derivative instruments (in millions):

Successor

2011

Interest

Rate

Caps

Interest

Rate

Swaps

Foreign

Currency

Forward

Contracts Total

Derivatives designated as cash flow hedging instruments:

Gain (loss) recognized in other comprehensive income (effective portion) $ (67.2) $ — $ — $ (67.2)

Gain (loss) reclassified from AOCI into interest expense, net(1) $ 0.5 $ — $ — $ 0.5

Derivatives not designated as hedging instruments:

Gain (loss) recognized in other operating expense, net $ — $ — $ 0.1 $ 0.1

Gain (loss) recognized in interest expense, net $ — $ (0.1) $ — $ (0.1)

(1) Includes zero in gains for the fiscal year ended December 31, 2011 related to terminated hedges.

115

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠