Burger King 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

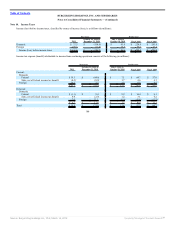

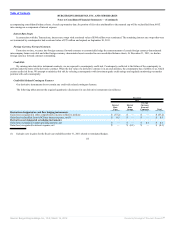

The assumed healthcare cost trend rates are as follows:

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010

Fiscal

2010

Fiscal

2009

Healthcare cost trend rate assumed for next year 8.00% 8.00% 8.00% 8.00% 8.50%

Rate to which the cost trend rate is assumed to decline

(the ultimate trend rate) 5.00% 5.00% 5.00% 5.00% 5.00%

Year that the rate reaches the ultimate trend rate 2020 2020 2020 2020 2016

Assumed healthcare cost trend rates do not have a significant effect on the amounts reported for the postretirement healthcare plans, since a one-percentage

point increase or decrease in the assumed healthcare cost trend rate would have a minimal effect on service and interest cost for the postretirement obligation.

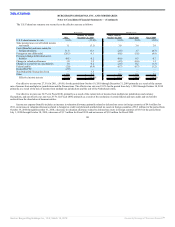

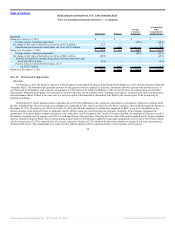

Plan Assets

The fair value of the major categories of pension plan assets for U.S. and International Pension Plans at December 31, 2011 is presented below (in

millions):

Successor Predecessor

U.S.

Pension Plans

International

Pension Plan

U.S.

Pension Plan

Internation

Pension Plan

U.S.

Pension Plans

International

Pension Plans

As of December 31, As of June 30,

2011 2010 2010

Level 2

Cash and Cash equivalents(a) $ 1.0 $ — $ 8.0 $ 0.2 $ 7.7 $ 0.3

Equity Securities(b):

U.S. 64.4 3.6 58.1 4.0 49.2 3.2

Non — U.S. 13.3 10.5 13.6 10.7 11.8 8.3

Fixed Income(b):

Corporate Bonds and Notes 24.9 — 24.1 — 20.6 —

U.S. Government Treasuries 6.2 — 7.2 — 6.3 —

International Debt 7.6 — 5.7 — 4.9 —

Mortgage-Backed Securities 1.3 — 0.8 — 4.5 —

U.S. Government Agencies 2.3 — 1.8 — 1.9 —

Asset-Backed Securities 0.3 — 0.3 — 1.0 —

Municipal Bonds 3.1 — 1.1 — 0.8 —

Non-U.S. Bonds 0.8 6.6 0.3 6.8 0.2 6.2

Other(c) 3.8 0.4 1.1 0.4 0.8 0.3

Total fair value of plan assets $ 129.0 $ 21.1 $ 122.1 $ 22.1 $ 109.7 $ 18.3

(a) Short-term investments in money market funds and short term receivables for investments sold

110

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠