Burger King 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

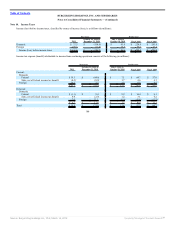

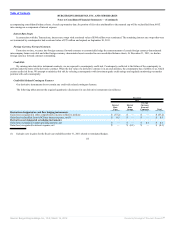

International Pension Plans

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010

Fiscal

2010

Fiscal

2009

Discount rate as of year-end 4.82% 5.35% 4.98% 5.17% 6.00%

Range of compensation rate increase 3.44% 3.80% 3.52% 3.71% 3.53%

The discount rate used in the calculation of the benefit obligation at December 31, 2011 for the U.S. Plans is derived from a yield curve comprised of the

yields of approximately 540 market-weighted corporate bonds, rated AA on average by Moody’s, Standard & Poors, and Fitch, matched against the cash flows of

the U.S. Plans. The discount rate used in the calculation of the benefit obligation for the U.S. Plans in prior periods was derived from a yield curve comprised of

the yields of approximately 360 equally-weighted corporate bonds, rated AA or better by Moody’s or Standard & Poors, matched against the cash flows of the

U.S. Plans.

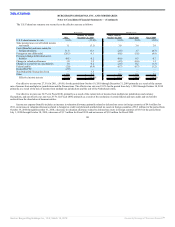

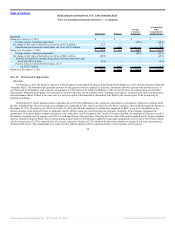

The weighted-average assumptions used in computing the net periodic benefit cost of the U.S. Pension Plans and the U.S. Retiree Medical Plan are as

follows:

U.S. Pension Plans U.S. Retiree Medical Plan

Successor Predecessor Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010

Fiscal

2010

Fiscal

2009 2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010

Fiscal

2010

Fiscal

2009

Discount rate 5.35% 5.06% 5.16% 6.37% 6.10% 5.35% 5.06% 5.16% 6.37% 6.10%

Expected long-term

rate of return on

plan assets 7.50% 7.50% 7.50% 7.50% 8.25% N/A N/A N/A N/A N/A

International Pension Plans

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010

Fiscal

2010

Fiscal

2009

Discount rate 5.38% 5.15% 5.09% 6.07% 5.89%

Range of compensation rate increase 3.79% 3.66% 3.58% 3.57% 3.88%

Expected long-term rate of return on plan assets 6.49% 6.10% 6.37% 6.42% 6.51%

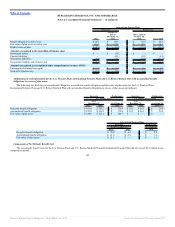

The expected long-term rate of return on plan assets is determined by expected future returns on the asset categories in target investment allocation. These

expected returns are based on historical returns for each asset’s category adjusted for an assessment of current market conditions.

109

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠