Burger King 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

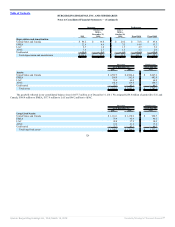

for Fiscal 2010 and $11.4 million for Fiscal 2009. The related excess tax benefits from stock options exercised were $1.1 million offset by $1.5 million shortfalls

recorded as operating cash flows for the period July 1, 2010 through October 18, 2010, $3.5 million for Fiscal 2010 and $3.3 million for Fiscal 2009.

Proceeds from stock options exercised were $4.0 million for the period July 1, 2010 through October 18, 2010, $4.2 million for Fiscal 2010 and

$3.0 million for Fiscal 2009.

The weighted average grant date fair value of nonvested shares granted was $16.96 during the period July 1, 2010 through October 18, 2010, $18.35 for

Fiscal 2010 and $25.10 for Fiscal 2009. The total intrinsic value of grants which vested and settled was $9.1 million during the period July 1, 2010 through

October 18, 2010, $9.6 million for Fiscal 2010 and $1.1 million for Fiscal 2009.

The fair value of shares withheld by us to meet employees’ minimum statutory withholding tax requirements on the settlement of RSU’s was $2.5 million

during the period July 1, 2010 through October 18, 2010, $2.7 million for Fiscal 2010 and $0.3 million for Fiscal 2009

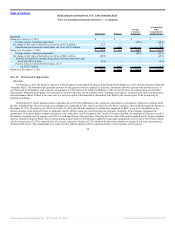

Note 16. Franchise and Property Revenues

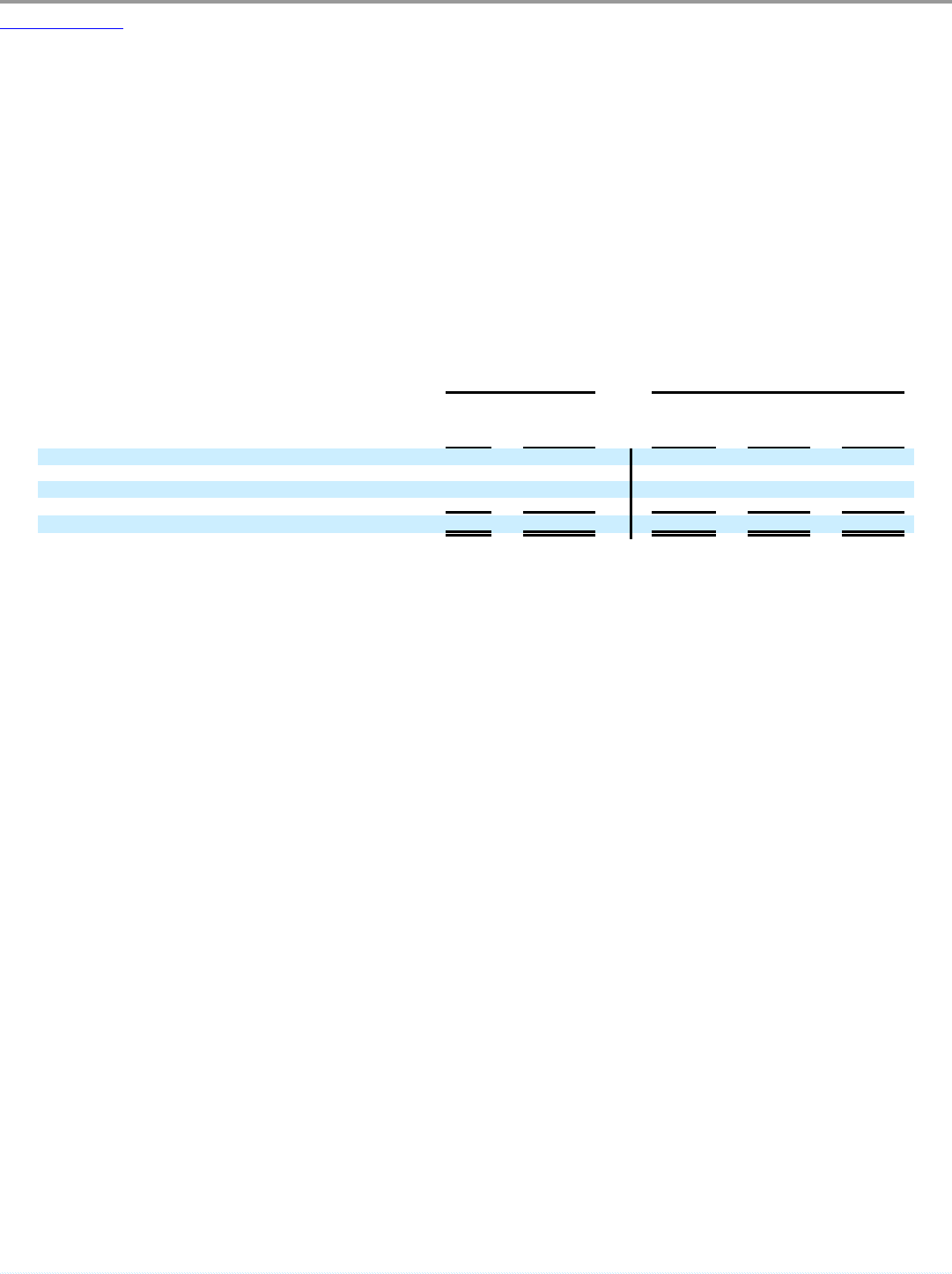

Franchise and property revenues consist of the following (in millions):

Successor Predecessor

2011

October 19,

2010 to

December 31,

2010

July 1,

2010 to

October 18,

2010 Fiscal 2010 Fiscal 2009

Franchise royalties $ 565.5 $ 107.4 $ 165.2 $ 529.5 $ 518.2

Initial franchise fees 13.3 2.6 1.7 10.9 13.8

Renewal franchise fees and other related fees 7.0 1.6 2.3 8.8 11.4

Property revenues 111.2 23.5 34.0 113.7 113.5

Total $ 697.0 $ 135.1 $ 203.2 $ 662.9 $ 656.9

Refer to Note 9 for the components of property revenues.

120

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠