Burger King 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

On April 19, 2011, BKCH, our direct parent, and Burger King Capital Finance, Inc., a Delaware corporation and another direct subsidiary of BKCH (“BK

Finance” and, together with BKCH, the “Issuers”) entered into an indenture with Wilmington Trust FSB, as trustee, pursuant to which the Issuers sold

$685 million in the aggregate principal amount at maturity of 11.0% senior discount notes due 2019 (the “Discount Notes”). The Discount Notes generated

$401.5 million in gross proceeds. Until April 15, 2016, no cash interest will accrue, but the Discount Notes will accrete at a rate of 11.0% per annum

compounded semi-annually such that the accreted value on April 15, 2016 will be equal to the principal amount at maturity. Thereafter, cash interest on the

Discount Notes will accrue at a rate equal to 11.0% per annum and will be payable semi-annually in cash in arrears on April 15 and October 15 of each year,

commencing on October 15, 2016. The Discount Notes will mature on April 15, 2019. Neither we nor BKC are a guarantor of the Discount Notes. The Issuers

have no operations or assets other than the interest in BKH held by BKCH. Accordingly, the cash required to service the Discount Notes is expected to be funded

through distributions from BKH.

On October 19, 2011, the Board of Managers of BKCH approved a distribution to Parent. On December 16, 2011, the Board of Directors of Parent paid a

return of capital distribution to the shareholders of Parent, including 3G, in the amount of $393.4 million, representing the net proceeds from the sale of the

Discount Notes.

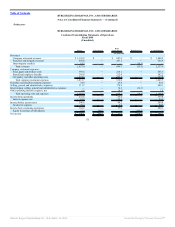

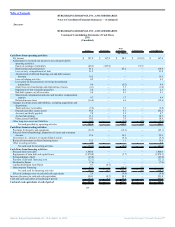

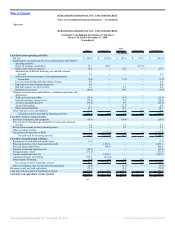

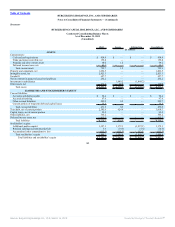

We are presenting the following condensed consolidating financial information for us and the Issuers, together with eliminations, as of and for the periods

indicated in accordance with the Indenture. The consolidating financial information may not necessarily be indicative of the financial position or results of

operations had the Issuers operated as independent entities.

141

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠