Burger King 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

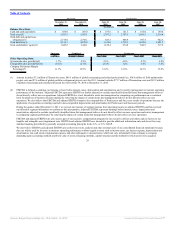

Table of Contents

Successor Predecessor

December 31,

2011

December 31,

2010

June 30,

2010

June 30,

2009

June 30,

2008

June 30,

2007

(In millions)

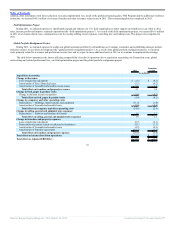

Balance Sheet Data:

Cash and cash equivalents $ 458.8 $ 207.0 $ 187.6 $ 121.7 $ 166.0 $ 169.4

Total assets(3) 5,583.5 5,683.1 2,747.2 2,707.1 2,686.5 2,516.8

Total debt and capital lease

obligations(3) 2,714.8 2,792.1 826.3 888.9 947.4 942.5

Total liabilities(3) 4,134.3 4,239.0 1,618.8 1,732.3 1,842.0 1,801.2

Total stockholders’ equity(3) 1,449.2 1,444.1 1,128.4 974.8 844.5 715.6

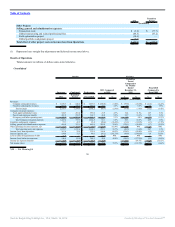

Successor Combined Predecessor

2011 Transition Period Fiscal 2010 Fiscal 2009 Fiscal 2008 Fiscal 2007

Other Operating Data:

Systemwide sales growth(4)(5) 1.7% 2.2% 2.1% 4.2% 8.3% 4.9%

Comparable sales growth(4)(5)(6) (0.5)% (2.7)% (2.3)% 1.2% 5.4% 3.4%

Company Restaurant Margin

Percentage(7) 11.7% 12.9% 12.2% 12.6% 14.3% 15.0%

(1) Amount includes $3.2 million of Transaction costs, $46.5 million of global restructuring and related professional fees, $10.6 million of field optimization

project costs and $7.6 million of global portfolio realignment project costs for 2011. Amount includes $77.7 million of Transaction costs and $67.2 million

of global restructuring and related professional fees for October 19, 2010 to December 31, 2010.

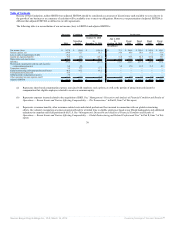

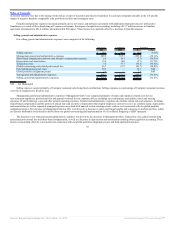

(2) EBITDA is defined as earnings (net income or loss) before interest, taxes, depreciation and amortization, and is used by management to measure operating

performance of the business. Adjusted EBITDA represents EBITDA as further adjusted to exclude specifically identified items that management believes

do not directly reflect our core operations. Adjusted EBITDA is a tool intended to assist our management in comparing our performance on a consistent

basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect our core

operations. We also believe that EBITDA and adjusted EBITDA improve the comparability of Predecessor and Successor results of operations because the

application of acquisition accounting resulted in non-comparable depreciation and amortization for Predecessor and Successor periods.

During the quarter ended December 31, 2011, we revised our measure of segment income from operating income to adjusted EBITDA and have revised

our historical segment information to conform to this presentation. Adjusted EBITDA represents earnings before interest, taxes, depreciation and

amortization, adjusted to exclude specifically identified items that management believes do not directly reflect our core operations and assists management

in comparing segment performance by removing the impact of certain items that management believes do not reflect our core operations.

EBITDA and adjusted EBITDA are also used as part of our incentive compensation program for our executive officers and others and are factors in our

tangible and intangible asset impairment tests. EBITDA and adjusted EBITDA are intended to provide additional information only and do not have any

standard meaning prescribed by generally accepted accounting principles in the U.S., or U.S. GAAP.

We also believe EBITDA and adjusted EBITDA are useful to investors, analysts and other external users of our consolidated financial statements because

they are widely used by investors to measure operating performance without regard to items such as income taxes, net interest expense, depreciation and

amortization, non-cash stock compensation expense and other infrequent or unusual items, which can vary substantially from company to company

depending upon accounting methods and book value of assets, financing methods, capital structure and the method by which assets were acquired.

29

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠