Burger King 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

We generated a federal net operating loss of approximately $12.5 million for the period ended December 31, 2011. This loss can be carried forward for 20

years. In addition, we generated a federal net operating loss of $195.0 million during the period from October 19, 2010 through December 31, 2010 of which the

entire amount was carried back to previous years. We have a state net operating loss carryforward of approximately $140.5 million, expiring between 2015 and

2031. In addition, we have foreign loss carryforwards of $328.4 million expiring between 2012 and 2031, and foreign loss carryforwards of $183.8 million that

do not expire. As of December 31, 2011, we have a foreign tax credit carryforward balance of $16.8 million. We have recorded valuation allowances related to

certain foreign and state losses and foreign tax credit carry forwards since it is more likely than not to expire unutilized.

Deferred taxes have not been provided on basis differences related to investments in foreign subsidiaries. These differences consist primarily of

approximately $222.9 million of undistributed earnings, which are considered to be permanently reinvested in the operations of such subsidiaries outside the

United States. Determination of the deferred income tax liability on these unremitted earnings is not practicable. Such liability, if any, depends on circumstances

existing if and when remittance occurs.

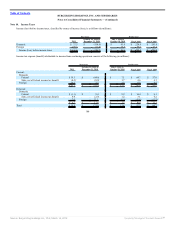

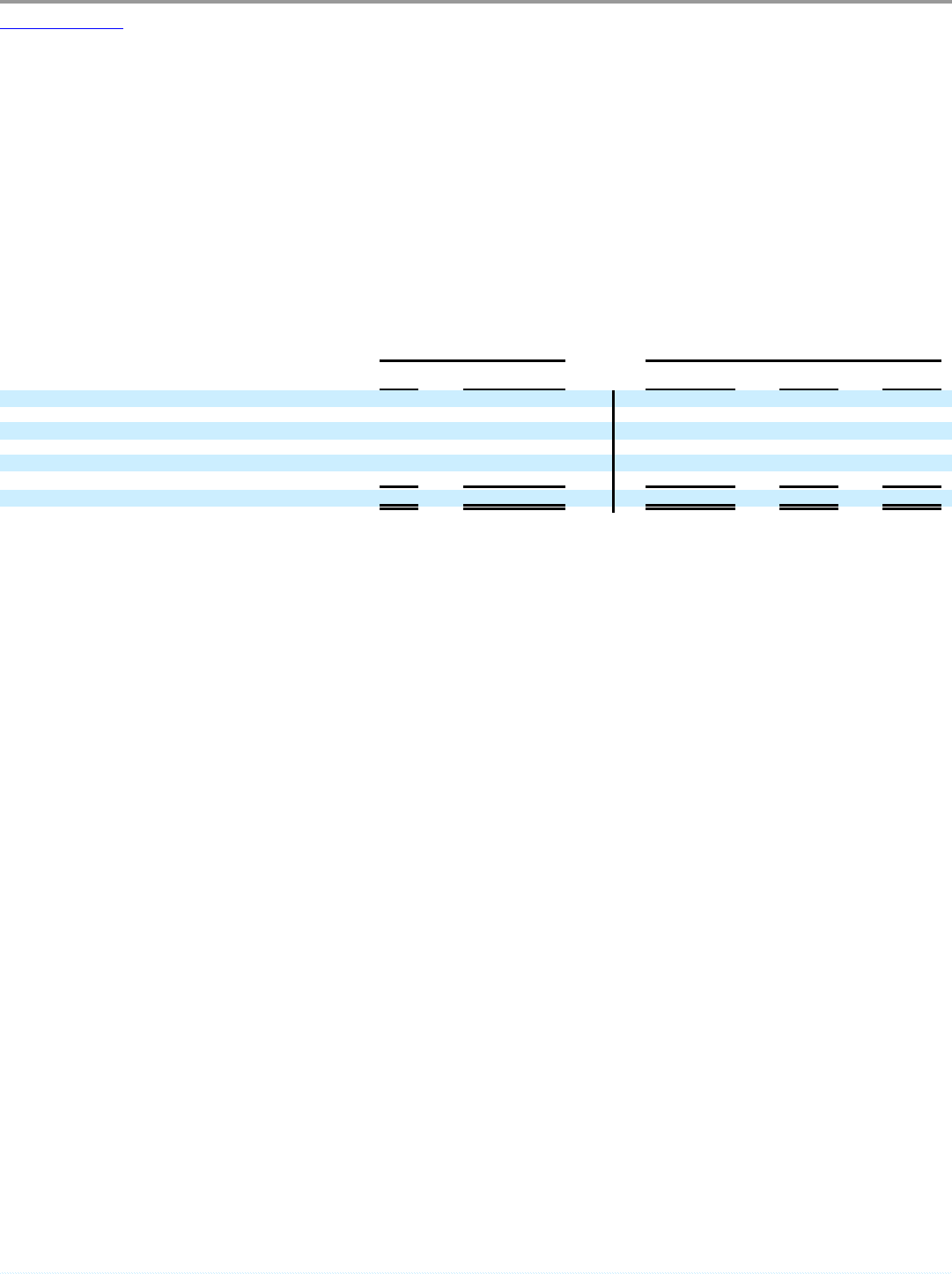

We had $21.6 million of unrecognized tax benefits at December 31, 2011, $22.4 million at December 31, 2010 and $14.2 million at June 30, 2010, which

if recognized, would affect the effective income tax rate. A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows:

Successor Predecessor

2011

October 19, 2010 to

December 31, 2010

July 1, 2010 to

October 18, 2010 Fiscal 2010 Fiscal 2009

Beginning balance $ 22.4 $ 22.2 $ 14.2 $ 15.5 18.3

Additions on tax position related to the current year 1.4 0.3 0.3 1.2 4.5

Additions for tax positions of prior years 2.8 — 0.3 2.7 1.9

Reductions for tax positions of prior years (2.9) (0.1) (2.6) (2.0) (7.7)

Reductions for settlements (2.0) — — (2.0) (0.2)

Reductions due to statute expiration (0.1) — — (1.2) (1.3)

Ending Balance $ 21.6 $ 22.4 $ 12.2 $ 14.2 $ 15.5

During the twelve months beginning January 1, 2012, it is reasonably possible we will reduce unrecognized tax benefits by approximately $1.5 million,

primarily as a result of the expiration of certain statutes of limitations and the resolution of audits.

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. The total amount of accrued interest and penalties at

December 31, 2011 was $3.2 million, at December 31, 2010 was $3.2 million and at June 30, 2010 was $2.9 million. Potential interest and penalties associated

with uncertain tax positions recognized during the year ended December 31, 2011 was zero, $0.1 million for the period October 19, 2010 through December 31,

2010, $0.1 million for the period July 1, 2010 through October 18, 2010, $0.6 million for the fiscal year ended June 30, 2010 and $0.6 million for the fiscal year

ended June 30, 2009. To the extent interest and penalties are not assessed with respect to uncertain tax positions, amounts accrued will be reduced and reflected

as a reduction of the overall income tax provision.

We file income tax returns, including returns for its subsidiaries, with federal, state, local and foreign jurisdictions. Generally we are subject to routine

examination by taxing authorities in these jurisdictions,

104

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠