Burger King 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Until April 15, 2016, no cash interest will accrue, but the Discount Notes will accrete at a rate of 11.0% per annum compounded semi-annually such that

the accreted value on April 15, 2016 will be equal to the principal amount at maturity. Thereafter, cash interest on the Discount Notes will accrue at a rate equal

to 11.0% per annum and will be payable semi-annually in cash in arrears on April 15 and October 15 of each year, commencing on October 15, 2016. The

Discount Notes will mature on April 15, 2019.

Neither BKH nor BKC is a guarantor of the Discount Notes. Therefore, the Discount Notes are not reflected in our Consolidated Financial Statements. The

Issuers have no operations or assets other than the interest in BKH held by BKCH. Accordingly, the cash required to service or repurchase the Discount Notes is

expected to be funded through dividends from BKH, which derives its cash flows entirely through the operations of BKC. The payment of such dividends may be

limited under terms of our Credit Agreement and Senior Notes Indenture. During 2011, BKH made a dividend to BKCH, which used the proceeds to repurchase

Discount Notes with an aggregate face value of $13.0 million and aggregate carrying value of $8.1 million, net of unamortized original issue discount. We may

make additional distributions or pay dividends to BKCH in the future subject to our future liquidity requirements, contractual restrictions under the Credit

Agreement and Senior Notes Indenture and other factors.

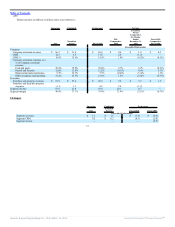

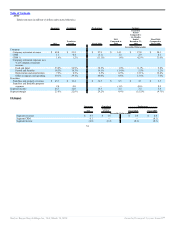

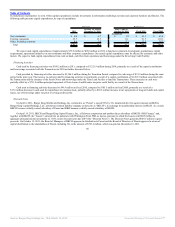

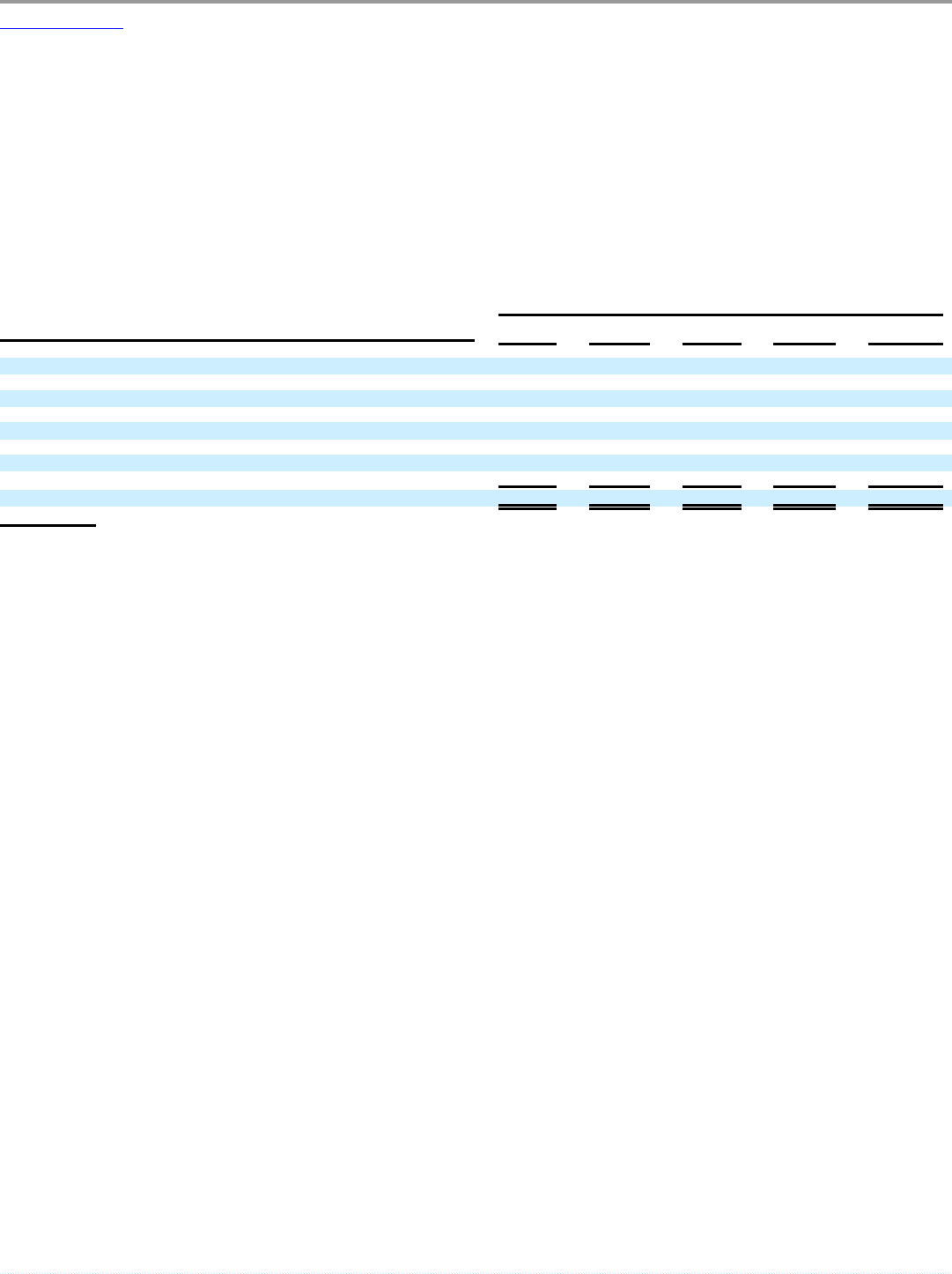

Contractual Obligations and Commitments

Payment Due by Period

Contractual Obligations Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

(In millions)

Capital lease obligations $ 157.6 $ 17.5 $ 34.6 $ 30.2 $ 75.3

Operating lease obligations(1) 1,246.0 146.8 262.4 223.6 613.2

Unrecognized tax benefits(2) 24.9 — — — —

Term debt, including current portion, interest and interest rate cap premiums(3) 2,225.2 109.5 216.0 1,899.7 —

Senior Notes, including interest 1,348.8 78.8 157.5 157.5 955.0

Severance and severance-related costs 25.7 25.4 0.3

Purchase commitments(4) 167.4 141.9 25.5 — —

Capex commitments 18.0 18.0 — — —

Total $ 5,213.6 $ 537.9 $ 696.3 $ 2,311.0 $ 1,643.5

(1) Operating lease obligations have not been reduced by minimum sublease rentals of $318.0 million due in the future under noncancelable subleases.

(2) We have provided only a total in the table above since the timing of the unrecognized tax benefit payments is unknown.

(3) We have estimated our interest payments through the maturity of our Credit Facilities and the Senior Notes based on (i) current LIBOR rates, (ii) the terms

of our interest rate caps (iii) the fixed interest rate on the Senior Notes and (iv) the amortization schedules in our Credit Agreement and the Senior Notes

Indenture.

(4) Includes open purchase orders, as well as commitments to purchase advertising and other marketing services from third parties in advance on behalf of the

Burger King system and obligations related to information technology and service agreements.

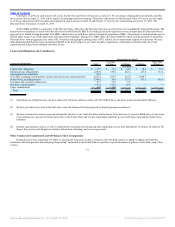

Other Commercial Commitments and Off-Balance Sheet Arrangements

During the fiscal year ended June 30, 2000, we entered into long-term, exclusive contracts with soft drink vendors to supply Company and franchise

restaurants with their products and obligating Burger King® restaurants in the United States to purchase a specified number of gallons of soft drink syrup. These

volume

61

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠