Burger King 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

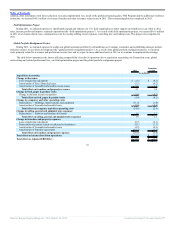

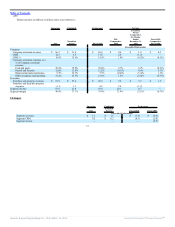

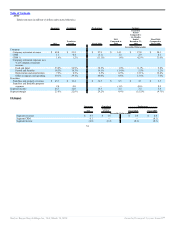

Our net income increased in 2011 primarily as a result of an increase in income from operations, partially offset by an increase in interest expense, the loss

we recorded on the early extinguishment of debt and an increase in income tax expense.

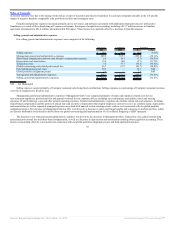

Transition Period compared to the Six Months Ended December 31, 2009

The decrease in consolidated adjusted EBITDA in the Transition Period was driven primarily by an increase in Unallocated Management G&A and a

decrease in segment income in the U.S. and Canada, partially offset by increases in segment income for EMEA, LAC and APAC.

The decrease in income from operations in the Transition Period was driven by Transaction costs and the costs of our global restructuring and field

optimization project, an increase in depreciation and amortization, primarily as a result of acquisition accounting, and a decrease in consolidated adjusted

EBITDA. These factors were partially offset by an increase in other (income) expense, net and decrease in share-based compensation expense.

Our net income decreased in the Transition Period primarily as a result of an increase in interest expense following the Transactions and a decrease in

income from operations, partially offset by a decrease in income tax expense.

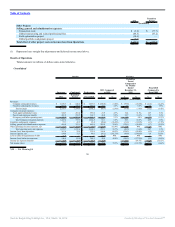

Fiscal 2010 compared to Fiscal 2009

The increase in consolidated adjusted EBITDA in Fiscal 2010 was driven primarily by increases in segment income in the U.S. and Canada, EMEA and

APAC partially offset by an increase in Unallocated Management G&A.

The decrease in income from operations in Fiscal 2010 was driven by an increase in depreciation and amortization and an increase in share-based

compensation expense. These factors were partially offset by an increase in adjusted EBITDA and other operating expenses, net.

Our net income decreased in Fiscal 2010 primarily as a result of a decrease in income from operations, and an increase in income tax expense, partially

offset by a decrease in interest expense, net.

44

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠