Burger King 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Insurance Reserves

We carry insurance to cover claims such as workers’ compensation, general liability, automotive liability, executive risk and property, and we are

self-insured for healthcare claims for eligible participating employees. Through the use of insurance program deductibles (ranging from $0.1 million to

$2.5 million) and self insurance, we retain a significant portion of the expected losses under these programs. Insurance reserves have been recorded based on our

estimates of the anticipated ultimate costs to settle all claims, both reported and incurred-but-not-reported (IBNR).

Our accounting policies regarding these insurance programs include judgments and independent actuarial assumptions about economic conditions, the

frequency or severity of claims and claim development patterns and claim reserve, management and settlement practices. Since there are many estimates and

assumptions involved in recording insurance reserves, differences between actual future events and prior estimates and assumptions could result in adjustments to

these reserves.

See Note 18 of the accompanying audited Consolidated Financial Statements included in Part II, Item 8 “Financial Statements and Supplementary Data”

for additional information about accounting for our insurance reserves.

New Financial Accounting Standards Board (FASB) Accounting Standards Updates Issued But Not Yet Adopted

In May 2011, the FASB issued an accounting standards update to amend the accounting standard on fair value measurements. The amendment includes

clarifications of the Board’s intent about the application of existing fair value measurement requirements and expands fair value measurement disclosure

requirements. The amendments in this accounting standards update are effective for fiscal years, and interim periods, beginning after December 15, 2011, which

for us will be January 1, 2012. We have not yet determined the impact, if any, the adoption of the amendments in this accounting standards update will have on

our financial position, results of operations or cash flows.

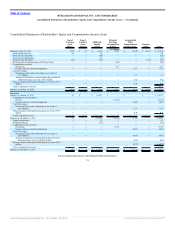

In June 2011, the FASB issued an accounting standards update that eliminates the option to present components of other comprehensive income as part of

the statement of changes in stockholders’ equity. All non-owner changes in stockholders’ equity will be presented either in a single continuous statement of

comprehensive income or in two separate but consecutive statements. The amendments in this accounting standards update are effective for fiscal years, and

interim periods, beginning after December 15, 2012, which for us will be January 1, 2013. The amendments in this accounting standards update will affect the

presentation of comprehensive income and are not expected to have a significant effect on our financial position, results of operations or cash flows.

In September 2011, the FASB issued an accounting standards update to amend the accounting standard on goodwill impairment testing. The amendments

in this accounting standards update provide an option to qualitatively assess the likelihood of goodwill impairment before calculating the fair value of reporting

units to reduce the complexity of annual goodwill impairment testing. The amendments in this accounting standards update are effective for fiscal years, and

interim periods, beginning after December 15, 2011, which for us will be January 1, 2012. Early adoption is permitted. We do not expect the adoption of the

amendments in this accounting standards update will have a material impact on our financial position, results of operations or cash flows since they are intended

to reduce complexity in the impairment testing process.

In December 2011, the FASB issued an accounting standards update that requires an entity to disclose information about offsetting and related

arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The amendments in this

accounting standard update are effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those

65

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠