Burger King 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

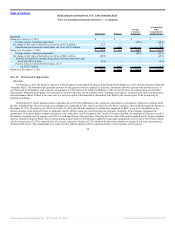

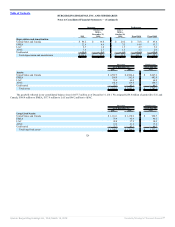

Derivatives Pensions

Foreign

Currency

Translation

Accumulated

Other

Comprehensive

Income (Loss)

Successor

Balances at October 19, 2010 $ — $ — $ — $ —

Foreign currency translation adjustment — — (48.5) (48.5)

Net change in fair value of derivatives, net of tax of $13.9 million 21.9 — — 21.9

Pension and post-retirement benefit plans, net of tax of $3.9 million — 8.8 — 8.8

Balances at December 31, 2010 $ 21.9 $ 8.8 $ (48.5) $ (17.8)

Foreign currency translation adjustment — — (44.3) (44.3)

Net change in fair value of derivatives, net of tax of $26.4 million (40.9) — — (40.9)

Amounts reclassified to earnings during the period from terminated caps,

net of tax of $0.4 million (0.6) — — (0.6)

Pension and post-retirement benefit plans, net of —

tax of $5.5 million — (9.7) — (9.7)

Balances at December 31, 2011 $ (19.6) $ (0.9) $ (92.8) $ (113.3)

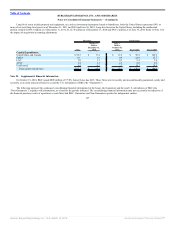

Note 15. Stock-based Compensation

Successor

On February 2, 2011, the Board of Directors of Parent approved and adopted the Burger King Worldwide Holdings, Inc. 2011 Omnibus Incentive Plan (the

“Omnibus Plan”). The Omnibus Plan generally provides for the grant of awards to employees, directors, consultants and other persons who provide services to

our Parent and its subsidiaries, with respect to an aggregate of 6,650 shares (6.65 million millishares or .001 of one full share) of common stock of our Parent.

The Omnibus Plan permits the grant of several types of awards with respect to the common stock, including stock options, restricted stock units, restricted stock

and performance shares. If there is an event such as a return of capital or dividend that is determined to be dilutive, the exercise price of the awards may be

adjusted accordingly.

During the 2011, Parent granted options to purchase up to 4,593,669 millishares to key employees and members of the Board of Directors of Parent under

the 2011 Omnibus Plan. The exercise price per millishare was originally $15.82, which was reduced to $11.89 as a result of a Special Dividend paid by Parent on

December 16, 2011. The options vest 100% on October 19, 2015, provided the employee is continuously employed by BKC or one of its subsidiaries or the

director remains on the board of Parent, as applicable, and the options expire ten years following the grant date. Generally, if the Company terminates the

employment of an option holder without cause prior to the vesting date, or if the employee dies, retires or becomes disabled, the employee will become vested in

the number of options as if the options vested 20% of each anniversary of the grant date. The grant date fair value of the options granted was $1.96 per millishare

and was estimated using the Black-Scholes option pricing model based on the following weighted-average input assumptions: exercise price of $15.82 per share;

risk-free interest rate of 1.93%; expected term of 5.0 years; expected volatility of 35.0% based on the historical volatility of a group of our peers; and expected

dividend yield of zero. The compensation cost related to these granted options will be recognized ratably over the requisite service period.

118

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠