Burger King 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

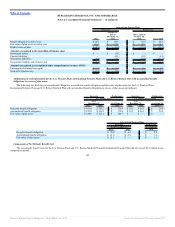

Our derivatives are valued using a discounted cash flow analysis that incorporates observable market parameters, such as interest rate yield curves and

currency rates, classified as Level 2 within the valuation hierarchy. Derivative valuations incorporate credit risk adjustments that are necessary to reflect the

probability of default by us or the counterparty.

At December 31, 2011, the fair value of our variable rate term debt and bonds were estimated at $2.6 billion, compared to a carrying amount of $2.6

billion, net of original issuance discount. At December 31, 2010, the fair value of our variable rate term debt and bonds was estimated at $2.7 billion, compared

to a carrying amount of $2.6 billion, net of original issuance discount. At June 30, 2010, the fair value of our variable rate term debt was estimated at

$744.4 million, compared to a carrying amount of $753.7 million. Refer to Note 2 for inputs used to estimate fair value.

Certain nonfinancial assets and liabilities are measured at fair value on a nonrecurring basis. These assets and liabilities are not measured at fair value on

an ongoing basis but are subject to periodic impairment tests. These items primarily include long-lived assets, goodwill and other intangible assets. Refer to

Note 2 for inputs and valuation techniques used to measure fair value of these nonfinancial assets.

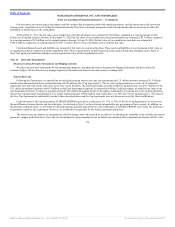

Note 13. Derivative Instruments

Disclosures about Derivative Instruments and Hedging Activities

We enter into derivative instruments for risk management purposes, including derivatives designated as hedging instruments and those utilized as

economic hedges. We use derivatives to manage exposure to fluctuations in interest rates and currency exchange rates.

Interest Rate Caps

Following the Transactions, we entered into two deferred premium interest rate caps, one denominated in U.S. dollars (notional amount of $1.5 billion)

and the other denominated in Euros (notional amount of €250 million) (the “Cap Agreements”). The six year Cap Agreements are a series of 25 individual

caplets that reset and settle on the same dates as the New Credit Facilities. The deferred premium associated with the Cap Agreements was $47.7 million for the

U.S. dollar denominated exposure and €9.4 million for the Euro denominated exposure. In connection with the Credit Agreement, we modified our interest rate

cap denominated in Euros to reduce its notional amount by €50 million throughout the life of the caplets. Additionally, we entered into a new deferred premium

interest rate cap agreement denominated in U.S. dollars (notional amount of $90 million) with a strike price of 1.50% (the “New Cap Agreement”). The terms of

the New Cap Agreement are substantially similar to those described above and the Cap Agreements were not otherwise revised by these modifications.

Under the terms of the Cap Agreements, if LIBOR/EURIBOR resets above a strike price of 1.75% (1.50% for the New Cap Agreement), we will receive

the net difference between the rate and the strike price. As disclosed in Note 8, we have elected our applicable rate per annum as Euro currency. In addition, on

the quarterly settlement dates, we will remit the deferred premium payment (plus interest) to the counterparty. If LIBOR/EURIBOR resets below the strike price

no payment is made by the counterparty. However, we would still be responsible for the deferred premium and interest.

The interest rate cap contracts are designated as cash flow hedges and to the extent they are effective in offsetting the variability of the variable rate interest

payments, changes in the derivatives’ fair value are not included in current earnings but are included in accumulated other comprehensive income (AOCI) in the

114

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠