Burger King 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

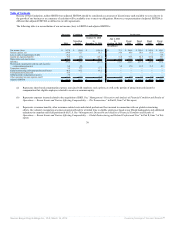

CRM % decreased due to sales deleverage on our fixed payroll and employee benefits and occupancy and other operating costs driven by negative

Company comparable sales growth and the impact of acquisition accounting. These factors were partially offset by improvements in variable labor controls and

scheduling in our U.S. restaurants, improved labor efficiencies in APAC and the U.K, the benefits realized from strategic pricing initiatives in the U.S. and

Canada, a non-recurring $4.7 million favorable adjustment to our self-insurance reserve in the U.S. and Canada and changes in product mix in LAC.

Franchise and Property

The increase in franchise and property revenues was driven by royalties derived from franchise NRG, a higher effective royalty rate in EMEA and the

impact of acquisition accounting adjustments. These factors were partially offset by the impact of negative franchise comparable sales growth on royalties and

contingent rents, unfavorable FX impact, a reduction in initial franchise fees and the net effect of changes to our portfolio of properties leased to franchisees.

Franchise and property expenses increased primarily due to rent expense associated with the net refranchising of 82 Company restaurants and franchise

NRG, an increase in bad debt expense and the impact of acquisition accounting, including a $3.1 million increase in franchise agreement amortization to $6.3

million. These factors were partially offset by favorable FX impact in EMEA.

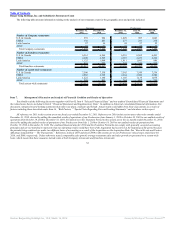

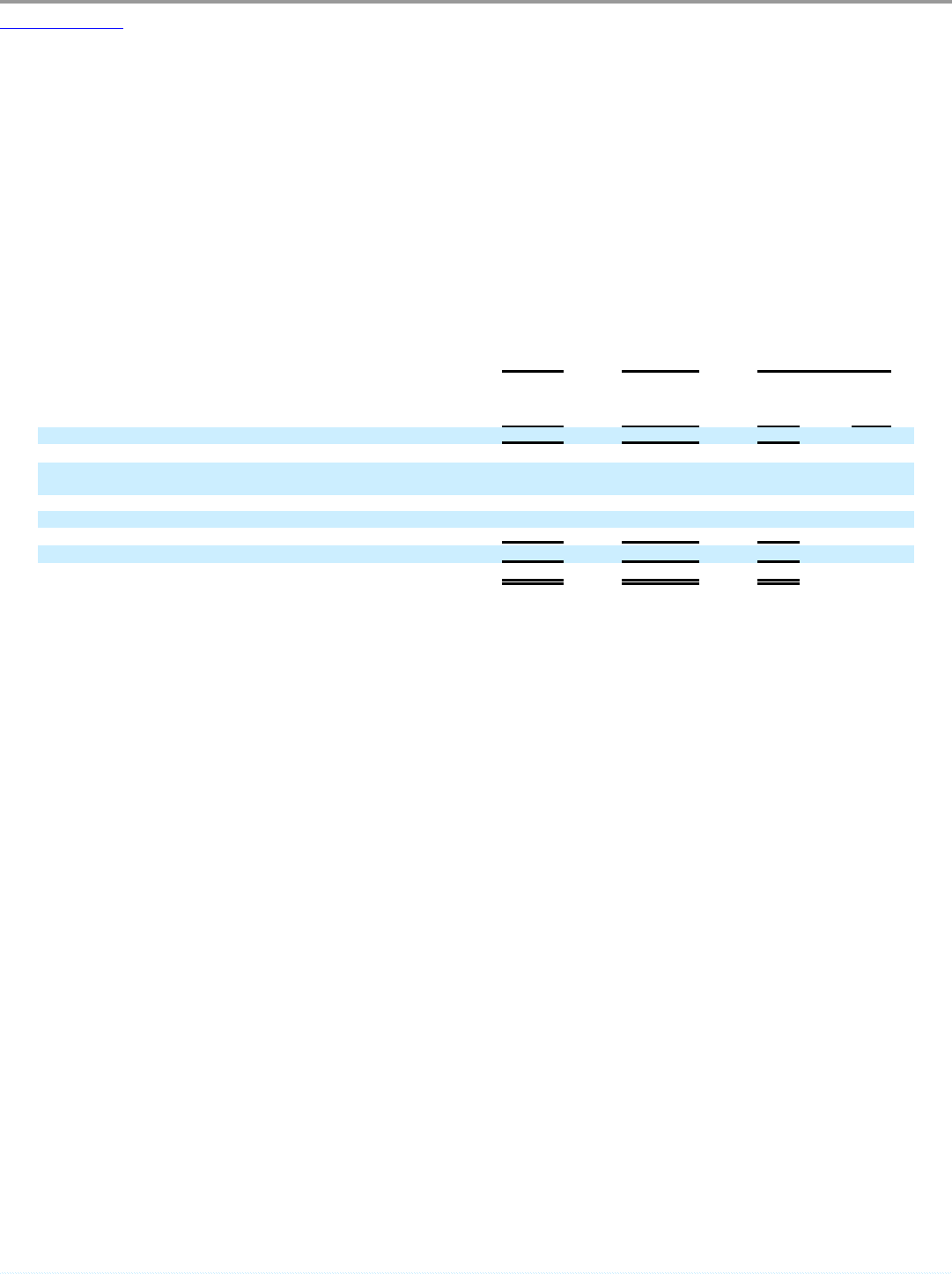

Selling, general and administrative expenses

Our selling, general and administrative expenses were comprised of the following:

Combined Predecessor Variance

Transition

Period

For the Six

Months Ended

December 31,

2009 $ %

Selling expenses $ 42.0 $ 47.1 $ (5.1) (10.8)%

Management general and administrative expenses 182.2 188.9 (6.7) (3.5)%

Share-based compensation and non-cash incentive compensation

expense 5.8 8.7 (2.9) (33.3)%

Depreciation and amortization 8.2 9.3 (1.1) (11.8)%

Transaction costs 77.7 — 77.7 0.0%

Global restructuring and related professional fees 67.2 — 67.2 0.0%

Total general and administrative expenses 341.1 206.9 134.2 64.9%

Selling, general and administrative expenses $ 383.1 $ 254.0 $129.1 50.8%

Selling expenses decreased due to the net refranchising of Company restaurants and a decrease in discretionary local marketing expenditures partially

offset by favorable FX impact.

The decrease in Management G&A was driven by a 19% decrease in travel and meeting costs and a 10% decrease in office operating expenses, partially

offset by an increase in a sales tax reserve.

The increase in our total general and administrative expenses was primarily due to transaction costs and global restructuring and related professional fees.

These factors were partially offset by a decrease in Management G&A.

40

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠