Burger King 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

commitments are not subject to any time limit and as of December 31, 2011, we estimate it will take approximately 14 years for these purchase commitments to

be completed.

During 2011, we entered into a five-year contract with a vendor to supply Company and franchise restaurants in LAC with soft drink products on an

exclusive basis and to supply Company and franchise restaurants in the United States with food products. We received upfront fees and contributions to our

marketing funds in connection with this agreement and may receive additional fees in the future in connection with the achievement of certain milestones. We

recognize the fees earned in connection with milestone achievement as franchise and property revenue when it is reasonably estimable and probable. Upfront fees

are amortized as franchise and property revenue over the term of the contract. As of December 31, 2011, the deferred income associated with this contract totaled

$4.5 million. Revenue recognized in connection with this arrangement was not material in 2011.

In the event of early termination of any of these arrangements, we may be required to make termination payments that could be material to our financial

position, results of operations and cash flows.

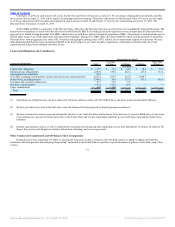

From time to time, we enter into agreements under which we guarantee loans made by third parties to qualified franchisees. As of December 31, 2011,

there were $24.2 million of loans outstanding to franchisees that we had guaranteed under two such programs, with additional franchisee borrowing capacity of

approximately $245 million remaining. Our maximum guarantee liability under these two programs is limited to an aggregate of $24.5 million, assuming full

utilization of all borrowing capacity. As of December 31, 2011, the liability we recorded to reflect the fair value of these guarantee obligations was not

material. No events of default have occurred and no payments have been made by us in connection with these guarantees through December 31, 2011.

Impact of Inflation

We believe that our results of operations are not materially impacted by moderate changes in the inflation rate. Inflation did not have a material impact on

our operations in 2011, the Transition Period, Fiscal 2010 or Fiscal 2009. Severe increases in inflation, however, could affect the global and U.S. economies and

could have an adverse impact on our business, financial condition and results of operations.

Critical Accounting Policies and Estimates

This discussion and analysis of financial condition and results of operations is based on our audited Consolidated Financial Statements, which have been

prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires our management to make

estimates and judgments that affect the reported amounts of assets, liabilities, revenues, and expenses, as well as related disclosures of contingent assets and

liabilities. We evaluate our estimates on an ongoing basis and we base our estimates on historical experience and various other assumptions we deem reasonable

to the situation. These estimates and assumptions form the basis for making judgments about the carrying values of assets and liabilities that are not readily

apparent from other sources. Volatile credit, equity, foreign currency and energy markets, and declines in consumer spending have increased and may continue to

create uncertainty inherent in such estimates and assumptions. As future events and their effects cannot be determined with precision, actual results could differ

significantly from these estimates. Changes in our estimates could materially impact our results of operations and financial condition in any particular period.

We consider our critical accounting policies and estimates to be as follows based on the high degree of judgment or complexity in their application:

Acquisition Accounting, Goodwill and Intangible Assets Not Subject to Amortization

The Acquisition was accounted for using the acquisition method of accounting, or acquisition accounting, in accordance with ASC Topic 805, Business

Combinations. Acquisition accounting involves the allocation of

62

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠