Burger King 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

loans and letters of credit) (the “Revolving Credit Facility,” and together with the Term Loan Facility, the “Credit Facilities”). The maturity date for the Term

Loan Facility is October 19, 2016 and the maturity date for the Revolving Credit Facility is October 19, 2015.

The principal amount of the Term Loan Facility amortizes in quarterly installments equal to 0.25% of the original principal amount of the Term Loan

Facility for the first five and three-quarter years, with the balance payable at maturity. The Credit Facilities contain customary provisions relating to mandatory

prepayments, voluntary prepayments, affirmative covenants, negative covenants and events of default. All obligations under the Credit Facilities are guaranteed

by BKH and each direct and indirect, existing and future, material domestic wholly-owned subsidiary of BKC.

Under the Credit Agreement, at BKC’s election, the interest rate per annum applicable to the loans is based on a fluctuating rate of interest determined by

reference to either (i) a base rate determined by reference to the higher of (a) the prime rate of JPMorgan Chase Bank, N.A., (b) the federal funds effective rate

plus 0.50% and (c) the Eurocurrency rate applicable for an interest period of one month plus 1.00%, plus an applicable margin equal to 2.00% for loans under the

U.S. dollar denominated tranche of the Term Loan Facility and 2.25% for loans under the Revolving Credit Facility, or (ii) a Eurocurrency rate determined by

reference to EURIBOR for the Euro denominated tranche and LIBOR for the U.S. dollar denominated tranche and Revolving Credit Facility, adjusted for

statutory reserve requirements, plus an applicable margin equal to 3.25% for loans under the Euro denominated tranche of the Term Loan Facility, 3.00% for

loans under the U.S. dollar denominated tranche of the Term Loan Facility and 3.25% for loans under the Revolving Credit Facility. Term Loan B borrowings

under the Credit Agreement are subject to a LIBOR floor of 1.50%. BKC has elected to borrow at the three month Euro currency rate as noted in (ii) above.

As of December 31, 2011, we had $14.5 million in irrevocable standby letters of credit outstanding, which were issued under the Revolving Credit Facility

primarily to certain insurance carriers to guarantee payments of deductibles for various insurance programs, such as health and commercial liability insurance.

Such letters of credit are secured by the collateral under the Credit Facilities. As of December 31, 2011, no amounts had been drawn on any of these irrevocable

standby letters of credit and our remaining borrowing capacity under the Revolving Credit Facility was $135.5 million as of December 31, 2011.

Following the end of each fiscal year, we are required to prepay the Term Loans in an amount equal to 50% of Excess Cash Flow (as defined in the Credit

Agreement and with stepdowns to 25% and 0% based on achievement of specified total leverage ratios), minus the amount of any voluntary prepayments of the

Term Loans during such fiscal year. Additionally, subject to certain exceptions, the Credit Facilities are subject to mandatory prepayment in the event of

non-ordinary course or other dispositions of assets (subject to customary reinvestment provisions), or in the event of issuances or incurrence of debt by BKC or

any of its subsidiaries (other than certain indebtedness permitted by the Credit Facilities).

We may prepay the term loans in whole or in part at any time. A 1% premium applies if the prepayment is made in connection with an interest rate

re-pricing event. During 2011, we made $60.5 million in voluntary prepayments of our Term Loans and, as a result, were not required to make a mandatory

prepayment based on Excess Cash Flow as described above.

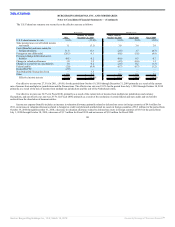

Under the Credit Facilities, BKC is required to comply with customary financial ratios, including a minimum Interest Coverage Ratio (the ratio of

Consolidated EBITDA to Consolidated Interest Expense) and a maximum Total Leverage Ratio (the ratio of Consolidated Total Debt to Consolidated EBITDA).

Consolidated EBITDA is defined as earnings before interest, taxes, depreciation and amortization, adjusted for certain items,

92

Source: Burger King Holdings Inc, 10-K, March 14, 2012 Powered by Morningstar® Document Research℠