ICICI Bank 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

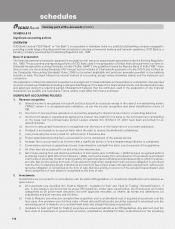

F13

period to maturity on constant yield basis. Quoted investments are valued based on the trades/quotes on the recognised

stock exchanges, subsidiary general ledger account transactions, price list of RBI or prices declared by Primary Dealers

Association of India jointly with Fixed Income Money Market and Derivatives Association, periodically.

The market/fair value of unquoted government securities which are in the nature of “SLR” securities included in the

‘Available for Sale’ and ‘Held for Trading’ categories is as per the rates published by Fixed Income Money Market

and Derivatives Association. The valuation of other unquoted fixed income securities wherever linked to the Yield-to-

Maturity (“YTM”) rates, is computed with a mark-up (reflecting associated credit risk) over the YTM rates for government

securities published by Fixed Income Money Market and Derivatives Association.

Unquoted equity shares are valued at the break-up value, if the latest balance sheet is available, or at Re. 1, as per

RBI guidelines.

Securities are valued scrip-wise and depreciation/appreciation is aggregated for each category. Net appreciation in

each category, if any, being unrealised, is ignored, while net depreciation is provided for.

d) Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are charged to

the profit and loss account.

e) Equity investments in subsidiaries/joint ventures are categorised as ‘Held to Maturity’ in accordance with

RBI guidelines.

f) Profit on sale of investments in the ‘Held to Maturity’ category is credited to the profit and loss account and is thereafter

appropriated (net of applicable taxes and statutory reserve requirements) to Capital Reserve. Profit on sale of investments

in ‘Available for Sale’ and ‘Held for Trading’ categories is credited to profit and loss account.

g) Repurchase and reverse repurchase transactions are accounted for in accordance with the extant RBI guidelines.

h) Broken period interest on debt instruments is treated as a revenue item.

i) At the end of each reporting period, security receipts issued by the asset reconstruction company are valued in

accordance with the guidelines applicable to such instruments, prescribed by RBI from time to time. Accordingly,

in cases where the cash flows from security receipts issued by the asset reconstruction company are limited to the

actual realisation of the financial assets assigned to the instruments in the concerned scheme, the Bank reckons the

net asset value obtained from the asset reconstruction company from time to time, for valuation of such investments

at each reporting year/period end.

j) The Bank follows trade date method for accounting of its investments.

3. Provisions/Write-offs on loans and other credit facilities

a) All credit exposures, including overdues arising from crystallised derivative contracts, are classified as per RBI guidelines,

into performing and non-performing assets (“NPAs”). Further, NPAs are classified into sub-standard, doubtful and loss

assets based on the criteria stipulated by RBI.

In the case of corporate loans, provisions are made for sub-standard and doubtful assets at rates prescribed by RBI.

Loss assets and the unsecured portion of doubtful assets are provided/written off as per the extant RBI guidelines.

Provisions on homogeneous retail loans, subject to minimum provisioning requirements of RBI, are assessed at a

portfolio level on the basis of days past due. The Bank holds specific provisions against non-performing loans and

general provision against performing loans. The assessment of incremental specific provisions is made after taking

into consideration existing specific provision. The specific provisions on retail loans held by the Bank are higher than

the minimum regulatory requirements.

b) Provision on assets restructured/rescheduled is made in accordance with the applicable RBI guidelines on restructuring

of advances by Banks.

In respect of non-performing loan accounts subjected to restructuring, the account is upgraded to standard only after

the specified period i.e., a period of one year after the date when first payment of interest or of principal, whichever

is earlier, falls due, subject to satisfactory performance of the account during the period.

c) Amounts recovered against debts written off in earlier years and provisions no longer considered necessary in the

context of the current status of the borrower are recognised in the profit and loss account.

d) In addition to the specific provision on NPAs, the Bank maintains a general provision on performing loans. The general

provision covers the requirements of the RBI guidelines.

e) In addition to the provisions required to be held according to the asset classification status, provisions are held for

individual country exposures (other than for home country exposure). The countries are categorised into seven risk

categories namely insignificant, low, moderate, high, very high, restricted and off-credit and provisioning is made on

exposures exceeding 180 days on a graded scale ranging from 0.25% to 100%. For exposures with contractual maturity

of less than 180 days, 25% of the above provision is required to be held. If the country exposure (net) of the Bank

in respect of each country does not exceed 1% of the total funded assets, no provision is required on such country

exposure.

forming part of the Accounts (Contd.)

schedules