ICICI Bank 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F37

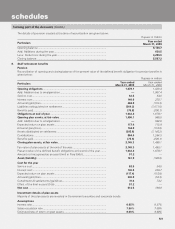

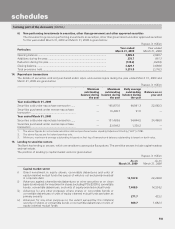

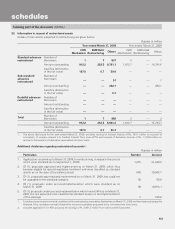

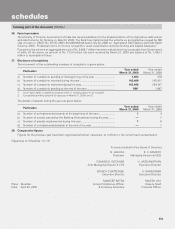

23. Information in respect of restructured assets

Details of loan assets subjected to restructuring are given below:

Rupees in million

Year ended March 31, 2009 Year ended March 31, 2008

CDR

Mechanism SME Debt

Restructuring Others CDR

Mechanism SME Debt

Restructuring Others

Standard advances

restructured Number of

Borrowers 1 7 937 2—1

Amount outstanding 912.2 252.5 9,781.1 1,013.7 — 14,781.6

Sacrifice (diminution

in the fair value) 107.0 0.7 59.6 ———

Sub-standard

advances

restructured

Number of

Borrowers ——51——1

Amount outstanding — — 202.1 — — 962.1

Sacrifice (diminution

in the fair value) — — 0.7 ———

Doubtful advances

restructured Number of

Borrowers ——————

Amount outstanding ——————

Sacrifice (diminution

in the fair value) ——————

Total Number of

Borrowers 1 7 988 2—2

Amount outstanding 912.2 252.5 9,983.2 1,013.7 — 15,743.7

Sacrifice (diminution

in the fair value) 107.0 0.7 60.3 ———

1. The above disclosure for the year ended March 31, 2009, excludes reversal of interest income of Rs. 159.1 million on account of

conversion of overdue interest into Funded Interest Term Loan (FITL) and reversal of derivative income of Rs. 1,134.5 million on

account of conversion of derivative receivables into term loans.

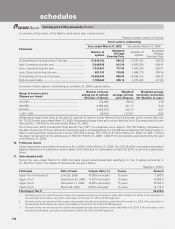

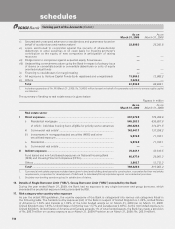

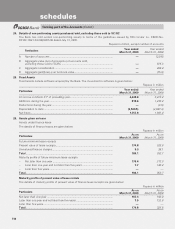

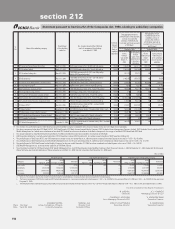

Additional disclosure regarding restructured accounts1:

Rupees in million

Particulars Number Amount

1. Applications received up to March 31, 2009, for restructuring, in respect of accounts

which were standard as on September 1, 200821,016 31,048.0

2. Of (1), proposals approved and implemented as on March 31, 2009, which thus

became eligible for special regulatory treatment and were classified as standard

assets as on the date of the balance sheet 945 10,945.7

3. Of (1), proposals approved and implemented as on March 31, 2009, but could not

be upgraded to the standard category 30 68.6

4. Of (1), proposals under process/implementation which were standard as on

March 31, 2009 38 19,875.1

5. Of (1), proposals under process/implementation which turned NPA as on March 31,

2009, but are expected to be classified as standard assets on full implementation

of the package 3 158.6

1. Excludes cases where terms and conditions of the restructuring were being finalised as on March 31, 2008 and have been subsequently

finalised. Also, excludes reversal of derivative income receivables proposed to be converted into term loans.

2. Includes applications for 950 accounts amounting to Rs. 2,001.2 million from various retail borrowers.

forming part of the Accounts (Contd.)

schedules