ICICI Bank 2009 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F87

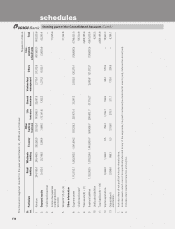

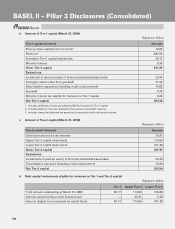

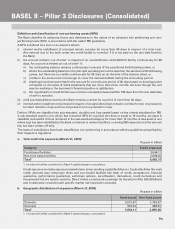

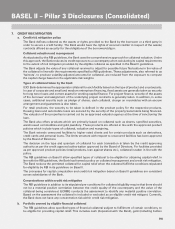

e. Total eligible capital (March 31, 2009)

Rupees in billion

Amount

Eligible Tier-1 capital 454.10

Eligible Tier-2 capital 192.94

Total eligible capital 647.04

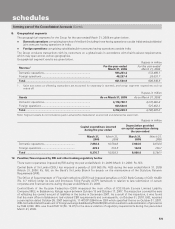

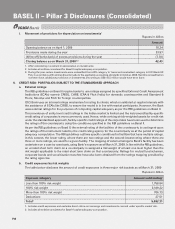

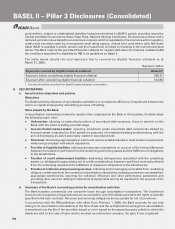

3. CAPITAL ADEQUACY

a. Capital assessment

The Bank is subject to the capital adequacy norms stipulated by the RBI guidelines on Basel II with effect

from March 31, 2008. Prior to March 31, 2008, the Bank was subject to the capital adequacy norms as

stipulated by the RBI guidelines on Basel I. The RBI guidelines on Basel II require the Bank to maintain a

minimum ratio of total capital to risk weighted assets of 9.0%, with a minimum Tier-1 capital adequacy

ratio of 6.0%. The total capital adequacy ratio of the Bank at a standalone level as at March 31, 2009 as per

the RBI guidelines on Basel II is 15.53% with a Tier-1 capital adequacy ratio of 11.84%. The total capital

adequacy ratio of the ICICI Group (consolidated) as at March 31, 2009 as per the RBI guidelines on Basel

II is 14.73% with a Tier-1 capital adequacy ratio of 10.34%.

Under Pillar 1 of the RBI guidelines on Basel II, the Bank follows the standardised approach for credit and

market risk and basic indicator approach (BIA) for operational risk. The Bank is in the process of setting

up a framework for the adoption of the advanced approaches under Basel II for measuring credit, market

and operational risks and aims to migrate to these approaches in line with the required approval and time

schedule stipulated by RBI.

In view of its transitional arrangements to the Basel II framework, the RBI has prescribed a parallel run

under which the Bank calculates capital adequacy under both Basel I and Basel II. Further at March 31, 2009,

the Bank is required to maintain capital adequacy based on the higher of the minimum capital required

under Basel II or at 90.0% of the minimum capital required under Basel I. The computation under Basel II

guidelines results in a higher minimum capital requirement as compared to Basel I and hence as a result

the capital adequacy as at March 31, 2009 has been maintained and reported by the Bank as per Basel II

guidelines.

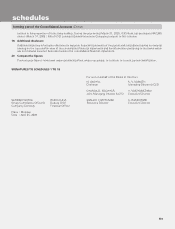

The Board of Directors of ICICI Bank maintains an active oversight over the Bank’s capital adequacy

levels. In line with the RBI guidelines, the Bank has a Board approved policy for internal capital adequacy

assessment process (ICAAP) and the outcomes of the ICAAP are presented to the Board on an annual

basis. The ICAAP encompasses the Bank’s capital planning for current and future periods. The Bank

determines its capital needs and the optimum level of capital taking into account the Bank’s strategic

focus, business plan, growth objectives and any other related factors including:

Regulatory capital requirements as per the RBI guidelines on Basel II;

Assessment of material risks;

Perception of credit rating agencies, shareholders and investors;

Future strategy with regard to investments or divestments in subsidiaries; and

Evaluation of capital raising options in the form of equity and hybrid/debt capital instruments from

domestic and overseas markets, as permitted by RBI from time-to-time.

The Bank also conducts stress tests and scenario analysis and factors the impact of the same in its capital

planning process. The Bank formulates its internal capital level targets based on the ICAAP and endeavours

to maintain its capital adequacy level in excess of the targeted levels at all times.

Thus, the Bank’s capital assessment and planning for current and future periods reflects the Bank’s capital

needs, planned capital consumption, desired level of capital, limits related to capital, management actions/

contingency plan for dealing with divergences and unexpected events and assessment for external and

internal sources of capital.

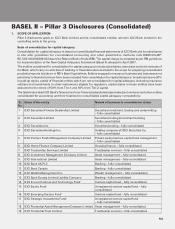

BASEL II – Pillar 3 Disclosures (Consolidated)