ICICI Bank 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F9

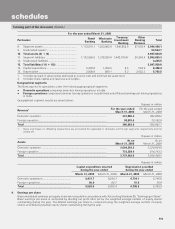

schedules

forming part of the Balance Sheet (Contd.) (Rs. in ‘000s)

As on

31.03.2009 As on

31.03.2008

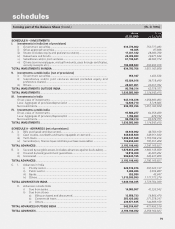

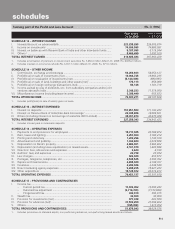

SCHEDULE 8 – INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ............................................................................. 633,774,902 753,777,483

ii) Other approved securities........................................................................ 93,405 97,946

iii) Shares (includes equity and preference shares) ...................................... 17,031,332 29,200,790

iv) Debentures and bonds ............................................................................ 26,000,683 18,871,649

v) Subsidiaries and/or joint ventures ............................................................ 61,194,621 46,382,774

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts etc.) ............................................................................... 196,688,823 202,833,016

TOTAL INVESTMENTS IN INDIA ........................................................................... 934,783,766 1,051,163,658

II. Investments outside India [net of provisions]

i) Government securities ............................................................................. 953,347 1,402,546

ii) Subsidiaries and/or joint ventures abroad (includes equity and

preference shares) ................................................................................... 65,924,016 38,719,449

iii) Others ....................................................................................................... 28,921,951 23,257,762

TOTAL INVESTMENTS OUTSIDE INDIA ............................................................... 95,799,314 63,379,757

TOTAL INVESTMENTS ........................................................................................... 1,030,583,080 1,114,543,415

III. Investments in India

Gross value of investments ............................................................................. 947,314,476 1,056,883,463

Less: Aggregate of provision/depreciation ..................................................... 12,530,710 5,719,805

Net investments ............................................................................................... 934,783,766 1,051,163,658

IV. Investments outside India

Gross value of investments ............................................................................. 97,586,277 64,358,489

Less: Aggregate of provision/depreciation ..................................................... 1,786,963 978,732

Net investments ............................................................................................... 95,799,314 63,379,757

TOTAL INVESTMENTS ........................................................................................... 1,030,583,080 1,114,543,415

SCHEDULE 9 - ADVANCES [net of provisions]

A. i) Bills purchased and discounted ............................................................... 40,610,992 46,763,159

ii) Cash credits, overdrafts and loans repayable on demand ...................... 343,945,509 348,051,840

iii) Term loans................................................................................................ 1,696,347,568 1,755,794,419

iv) Securitisation, finance lease and hire purchase receivables .................. 102,204,423 105,551,409

TOTAL ADVANCES ................................................................................................. 2,183,108,492 2,256,160,827

B. i) Secured by tangible assets (includes advances against book debts) ..... 1,575,653,288 1,693,135,659

ii) Covered by bank/government guarantees ............................................... 14,815,009 42,087,202

iii) Unsecured ................................................................................................ 592,640,195 520,937,966

TOTAL ADVANCES ................................................................................................. 2,183,108,492 2,256,160,827

C. I. Advances in India

i) Priority sector ................................................................................... 620,515,976 597,325,197

ii) Public sector ..................................................................................... 3,494,486 3,559,887

iii) Banks ................................................................................................ 252,580 45,947

iv) Others ............................................................................................... 1,015,930,993 1,177,773,278

TOTAL ADVANCES IN INDIA ................................................................................. 1,640,194,035 1,778,704,309

II. Advances outside India

i) Due from banks ................................................................................ 14,965,907 41,225,542

ii) Due from others

a) Bills purchased and discounted ............................................... 13,856,733 19,965,470

b) Commercial loans..................................................................... 283,420,282 271,379,347

c) Others ....................................................................................... 230,671,535 144,886,159

TOTAL ADVANCES OUTSIDE INDIA ..................................................................... 542,914,457 477,456,518

TOTAL ADVANCES ................................................................................................. 2,183,108,492 2,256,160,827