ICICI Bank 2009 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F94

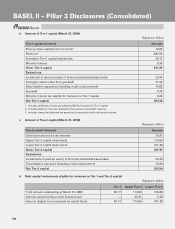

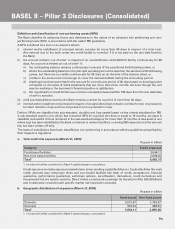

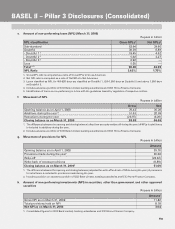

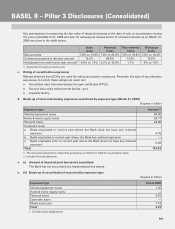

i. Movement of provisions for depreciation on investments1

Rupees in billion

Amount

Opening balance as on April 1, 2008 16.24

Provisions made during the year 33.97

(Write-off)/(write-back) of excess provisions during the year (7.78)

Closing balance as on March 31, 20092,3 42.43

1. After considering movement in appreciation on investments.

2. Includes all entities considered for Basel II capital adequacy computation.

3. During the year certain investments were reclassified from AFS category to ‘loans and receivables’ category in ICICI Bank UK

PLC, in accordance with ammendments made to the applicable accounting standards in October 2008. Had this reclassification

not been done, additional provisions on investments amounting to US$ 10.5 million would have been done.

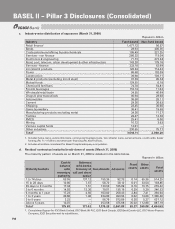

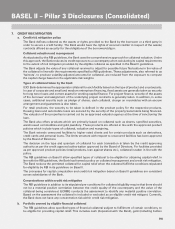

6. CREDIT RISK: PORTFOLIOS SUBJECT TO THE STANDARDISED APPROACH

a. External ratings

The RBI guidelines on Basel II require banks to use ratings assigned by specified External Credit Assessment

Institutions (ECAIs) namely CRISIL, CARE, ICRA & Fitch (India) for domestic counterparties and Standard &

Poors, Moodys and Fitch for foreign counterparties.

ICICI Bank uses an internal ratings mechanism for rating its clients, which is validated at regular intervals with

the assistance of ECAIs like CRISIL to ensure the model is in line with market participants. However, the Bank

uses external ratings for the purposes of computing capital adequacy as per the RBI guidelines on Basel II.

The prevalence of entity level credit ratings in the Indian market is limited and the instrument/facility-specific

credit rating of corporates is more commonly used. Hence, while arriving at risk-weighted assets for credit risk

under the standardised approach, facility-specific credit ratings of the corporates have been used to determine

the ratings of the counterparty using the conditions specified in the RBI guidelines on Basel II.

As per the RBI guidelines on Basel II, the external rating of the facilities of the counterparty is contingent upon

the ratings of the instrument rated by the credit rating agency for the counterparty as at the period of capital

adequacy computation. The RBI guidelines outlines specific conditions for facilities that have multiple ratings.

In this context, the lower rating, where there are two ratings and the second-lowest rating where there are

three or more ratings, are used for a given facility. The mapping of external ratings to Bank’s facility has been

undertaken on a case by case basis, using Bank’s exposure as at March 31, 2009. In line with the RBI guidelines,

an unrated short term claim on a counterparty is assigned a risk weight of at least one level higher than the

risk weight applicable to the rated short term claim on that counterparty. Ratings for mutual fund schemes,

corporate bonds and securitisation tranches have also been obtained from the ratings mapping provided by

the rating agencies.

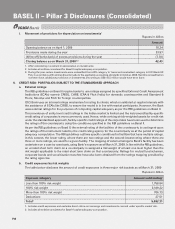

b. Credit exposures by risk weights

The table below discloses the amount of credit exposures in three major risk buckets as at March 31, 2009

Rupees in billion

Exposure category Amount outstanding1

Less than 100% risk weight 1,758.84

100% risk weight 3,189.22

More than 100% risk weight 706.73

Deductions 27.51

Total25,682.31

1. Includes credit exposures and excludes direct claims on sovereign and investments covered under specific market risk.

2. Includes all entities considered for Basel II capital adequacy computation.

BASEL II – Pillar 3 Disclosures (Consolidated)