ICICI Bank 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F66

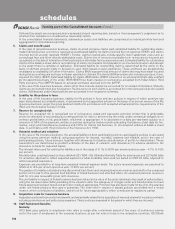

h) In the case of the Bank’s overseas banking subsidiaries, loans are stated net of allowance for credit losses. Loans

are classified as impaired when there is no longer reasonable assurance of the timely collection of the full amount of

principal or interest. An allowance for credit losses is maintained at a level that management considers adequate to

absorb identified credit related losses as well as losses that have been incurred but are not yet identifiable.

The total proportion of loans for which subsidiaries have applied accounting policies different from the Bank as mentioned

above, approximate 14.59% of the total loans as on March 31, 2009.

15. Transfer and servicing of assets

The Bank transfers commercial and consumer loans through securitisation transactions. The transferred loans are de-

recognised and gains/losses are accounted for only if the Bank surrenders the rights to benefits specified in the underlying

securitised loan contract. Recourse and servicing obligations are accounted for net of provisions.

In accordance with the RBI guidelines for securitisation of standard assets, with effect from February 1, 2006, the Bank

accounts for any loss arising from securitisation immediately at the time of sale and the profit/premium arising from

securitisation is amortised over the life of the securities issued or to be issued by the special purpose vehicle to which the

assets are sold. In the case of loans sold to an asset reconstruction company the gain, if any, is ignored.

16. Fixed assets and depreciation

Premises and other fixed assets are carried at cost less accumulated depreciation. Cost includes freight, duties, taxes and

incidental expenses related to the acquisition and installation of the asset. Depreciation is charged over the estimated useful

life of a fixed asset on a straight-line basis, the rates of depreciation for fixed assets are not lower than the rates prescribed

in Schedule XIV of the Companies Act, 1956.

Depreciation on leased assets and leasehold improvements is recognised on a straight-line basis using rates determined with

reference to the primary period of lease or rates specified in Schedule XIV of the Companies Act, 1956, whichever is higher.

Assets purchased/sold during the year are depreciated on a pro-rata basis for the actual number of days the asset has been

put to use.

Items costing up to Rs. 5,000 are depreciated fully over a period of 12 months from the date of purchase.

In case of revalued/impaired assets, depreciation is provided over the remaining useful life of the assets.

In case of the Bank’s life insurance subsidiary, intangible assets comprising software are stated at cost less amortisation.

Significant improvements to software are capitalised while the insignificant improvements are charged off as software

expenses. Software expenses, that are capitalised, are amortised on straight-line method over a period of four years from

the date they are put to use, being management’s estimate of the useful life of such intangibles. Depreciation on furniture

and fixtures is charged at the rate of 15% per annum.

In case of the Bank’s general insurance and housing finance subsidiaries, computer software is stated at cost less amortisation.

Computer software including improvements is amortised over a period of five years, being management’s estimate of the

useful life of such intangibles.

17. Accounting for derivative contracts

The Group enters into derivative contracts such as foreign currency options, interest rate and currency swaps, credit default

swaps and cross currency interest rate swaps.

The swap contracts entered to hedge on-balance sheet assets and liabilities are structured such that they bear an opposite

and offsetting impact with the underlying on-balance sheet items. The impact of such derivative instruments is correlated

with the movement of underlying assets and accounted pursuant to the principles of hedge accounting. Hedged swaps

are accounted for on an accrual basis except in the case of the Bank’s United Kingdom and Canadian banking subsidiaries,

where the hedging transactions and the hedged items (for the risks being hedged) are measured at fair value with changes

recognised in the profit and loss account.

Foreign currency and rupee derivative contracts entered into for trading purposes are marked to market and the resulting

gain/loss, (net of provisions, if any) is accounted for in the profit and loss account. Pursuant to RBI guidelines, any receivables

under derivative contracts, which remain overdue for more than 90 days, are reversed through profit and loss account.

18. Impairment of assets

Fixed assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the

carrying amount of an asset with future net discounted cash flows expected to be generated by the asset. If such assets

are considered to be impaired, the impairment is recognised by debiting the profit and loss account and is measured as

the amount by which the carrying amount of the assets exceeds the fair value of the assets.

19. Earnings per share (“EPS”)

Basic earnings per share is calculated by dividing the net profit or loss for the year attributable to equity shareholders by

the weighted average number of equity shares outstanding during the year.

Diluted earnings per share reflect the potential dilution that could occur if contracts to issue equity shares were exercised

or converted during the year. Diluted earnings per equity share is computed using the weighted average number of equity

shares and dilutive potential equity shares issued by the group outstanding during the year, except where the results are

anti-dilutive.

20. Lease transactions

Lease payments for assets taken on operating lease are recognised as an expense in the profit and loss account over the

lease term.

forming part of the Consolidated Accounts (Contd.)

schedules