ICICI Bank 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

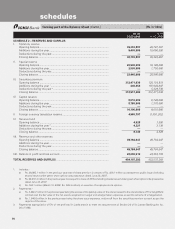

F4

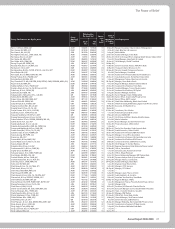

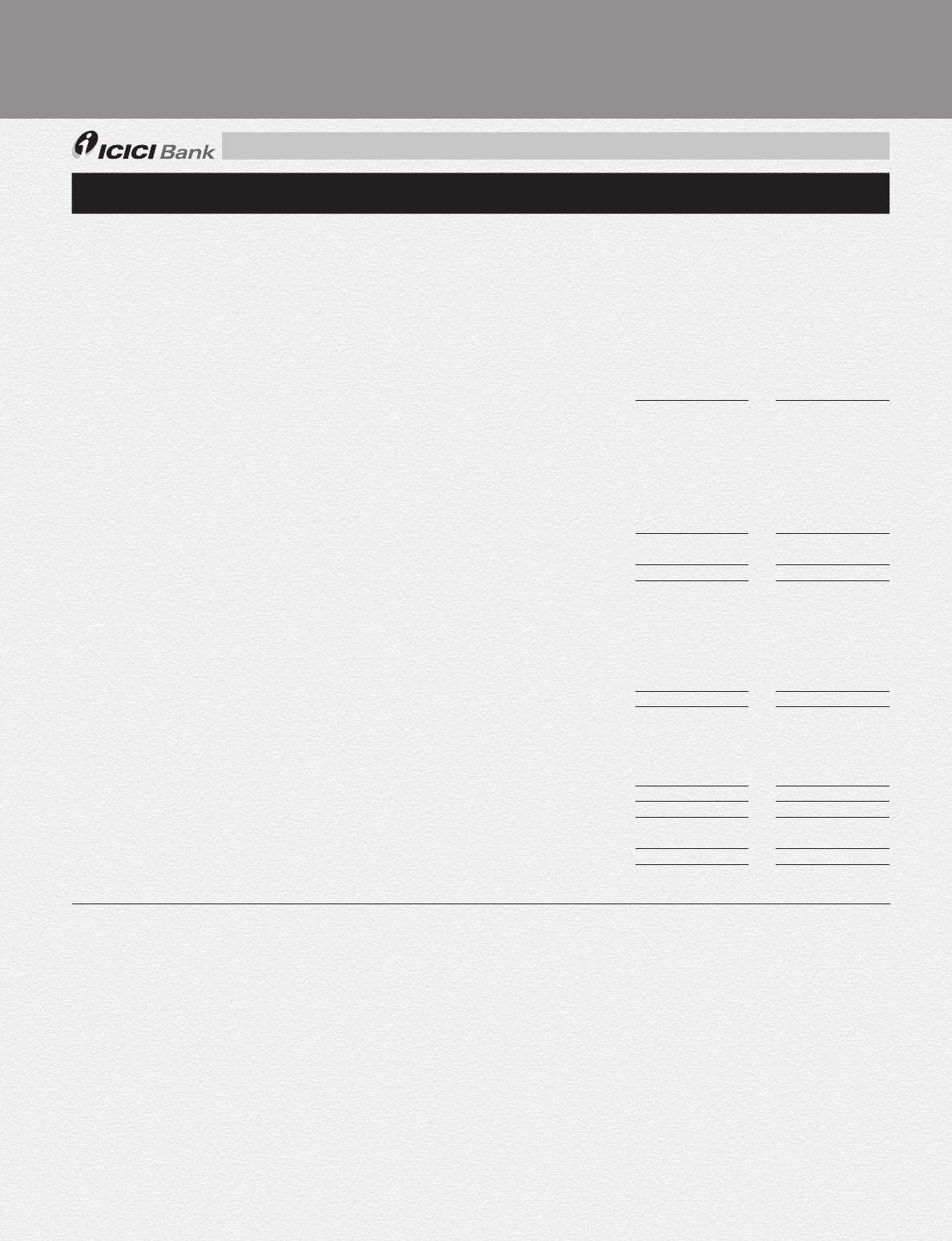

cash flow statement

for the year ended March 31, 2009 (Rs. in ‘000s)

PARTICULARS Year ended

31.03.2009 Year ended

31.03.2008

Cash flow from operating activities

Net profit before taxes

.......................................................................... 51,169,693 50,560,977

Adjustments for:

Depreciation and amortisation .............................................................. 8,576,435 7,711,011

Lease Equalisation ............................................................................... — —

Net (appreciation)/depreciation on investments................................... 13,371,083 10,279,608

Provision in respect of non-performing assets (including prudential

provision on standard assets) ............................................................... 37,500,259 27,009,924

Provision for contingencies & others .................................................... (395,005) 1,413,354

Income from subsidiaries, joint ventures and consolidated entities .... (3,636,999) (12,783,599)

(Profit)/Loss on sale of fixed assets ...................................................... (175,113) (656,069)

106,410,353 83,535,206

Adjustments for:

(Increase)/decrease in investments ...................................................... 26,560,241 (25,015,908)

(Increase)/decrease in advances ........................................................... 34,618,121 (320,850,355)

Increase/(decrease) in borrowings ........................................................ 32,785,480 43,122,293

Increase/(decrease) in deposits ............................................................ (260,832,253) 126,079,339

(Increase)/decrease in other assets ...................................................... (33,283,816) (27,149,533)

Increase/(decrease) in other liabilities and provisions .......................... (32,683,319) 22,330,716

(232,835,546) (181,483,448)

Refund/(payment) of direct taxes ......................................................... (15,459,704) (18,363,292)

Net cash generated from operating activities ...................................

(A)

(141,884,897) (116,311,534)

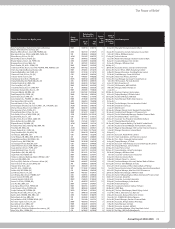

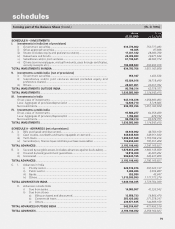

Cash flow from investing activities

Investments in subsidiaries and/or joint ventures

(including application money) ............................................................... (42,016,414) (44,379,917)

Income from subsidiaries, joint ventures and consolidated entities .... 3,636,999 12,783,799

Purchase of fixed assets ....................................................................... (10,568,742) (9,592,487)

Proceeds from sale of fixed assets ...................................................... 667,236 1,064,035

(Purchase)/sale of held to maturity securities ...................................... 86,859,726 (135,486,579)

Net cash generated from investing activities ...................................

(B)

38,578,805 (175,611,149)

Cash flow from financing activities

Proceeds from issue of share capital (including ESOPs) net of issue

expenses ............................................................................................... 452,464 197,897,060

Net proceeds/(repayment) of bonds (including subordinated debt) .... 29,492,463 112,316,167

Dividend and dividend tax paid ............................................................. (13,691,338) (10,565,000)

Net cash generated from financing activities....................................

(C)

16,253,589 299,648,227

Effect of exchange fluctuation on translation reserve ......................

(D)

6,306,853 (890,065)

Net cash and cash equivalents taken over from Sangli Bank

Limited on amalgamation ...................................................................

(E)

— 2,362,563

Net increase/(decrease) in cash and cash equivalents .....................

(A) + (B) + (C) + (D) + (E)

(80,745,650) 9,198,042

Cash and cash equivalents at April 1 ................................................. 380,411,288 371,213,247

Cash and cash equivalents at March 31 ............................................ 299,665,638 380,411,289

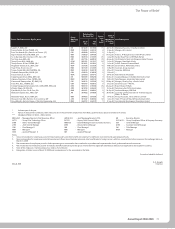

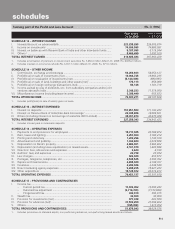

Significant accounting policies and notes to accounts (refer Schedule 18 & 19)

The schedules referred to above form an integral part of the Balance Sheet.

As per our Report of even date. For and on behalf of the Board of Directors

For B S R & Co. N. VAGHUL K. V. KAMATH

Chartered Accountants Chairman Managing Director & CEO

AKEEL MASTER CHANDA D. KOCHHAR V. VAIDYANATHAN

Partner Joint Managing Director & CFO Executive Director

Membership No.: 046768

SONJOY CHATTERJEE K. RAMKUMAR

Executive Director Executive Director

SANDEEP BATRA RAKESH JHA

Place : Mumbai Group Compliance Officer Deputy Chief

Date : April 25, 2009 & Company Secretary Financial Officer