ICICI Bank 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45Annual Report 2008-2009

The Power of Belief

Management’s Discussion & Analysis

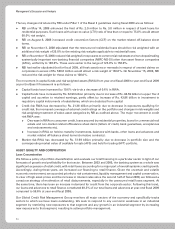

BACKGROUND

The first half of fiscal 2009 was characterised by increasing inflation and interest rates. Equity markets weakened

due to global macroeconomic concerns and a reversal in the pattern of global capital flows. Despite these

developments, the operating environment remained stable with continued corporate investment in India as well

as outbound merger and acquisition activity and robust demand for retail savings and investment products.

The bankruptcy of Lehman Brothers in September 2008 led to a rapid deterioration of the global macroeconomic

environment and a sharp moderation in global economic activity. In India, this impact was felt mainly

through the trade and capital flow channels. As a result, there was a sharp reduction in domestic liquidity in

September–October 2008. The decline in global commodity prices led to a moderation in inflation and facilitated

substantial reductions in key policy rates and reserve requirements. Inflation based on Wholesale Price Index

moderated from a peak of 12.9% in August 2008 to 0.3% at year-end fiscal 2009. Since October 2008, Reserve

Bank of India (RBI) has reduced the cash reserve ratio (CRR) by 400 basis points to 5.0%, the statutory liquidity

ratio (SLR) by 100 basis points to 24.0%, the repo rate by 425 basis points to 4.75% and the reverse repo rate by

275 basis points to 3.25%. The reduction in policy rates led to a reduction in market interest rates with the yield

on 10-year government securities declining by about 320 basis points in the quarter ended December 31, 2008

(Q3-2009). During the quarter ended March 31, 2009 (Q4-2009), the yield on government securities increased

by about 175 basis points following a larger than expected government borrowing programme. Equity markets

continued to remain weak with the BSE Sensex declining from a peak of 17,600 on May 2, 2008 to 9,709 at

year-end fiscal 2009. The rupee depreciated from Rs. 40.12 per US dollar at year-end fiscal 2008 to Rs. 50.72 per

US dollar at year-end fiscal 2009.

The Central Statistical Organisation (CSO) placed GDP growth at 7.8% during the first half of fiscal 2009 compared

to 9.3% during the first half of fiscal 2008. During the third quarter of fiscal 2009, GDP growth moderated to 5.3%

mainly due to a 2.2% decline in agricultural growth and a moderation of industrial sector growth to 0.8%.

The trends in the economy were also reflected in the banking sector. Non-food credit growth in the system

increased to about 30.0% on a year-on-year basis during October-November 2008 from about 22.0% at year-end

fiscal 2008, before moderating significantly to 17.5% at year-end fiscal 2009. Growth in total deposits moderated

from about 24.0% on a year-on-year basis in November 2008 to about 20.0% at year-end fiscal 2009. The growth

in total deposits was due to a 24.0% growth in time deposits in fiscal 2009, as demand deposits in the system

contracted by about 1.0% during fiscal 2009.

Given the uncertain and volatile economic environment, we accorded priority to risk containment, liquidity

management and capital conservation. In view of high asset prices and the increase in interest rates since the

second half of fiscal 2008, we followed a conscious strategy of moderation of retail disbursements, especially

in the unsecured retail loans segment. The weak equity markets and reduction in demand for retail savings and

investment products as also corporate investment and M&A activity during the second half of fiscal 2009 had

a negative impact on our fee and other non-interest income (including dividend from subsidiaries). While we

capitalised on opportunities in the fixed income markets due to reduction in interest rates during Q3-2009, our

equity, fixed income and credit derivative portfolios were negatively impacted due to weaker equity markets,

volatile interest rates and a widening of credit spreads during fiscal 2009.

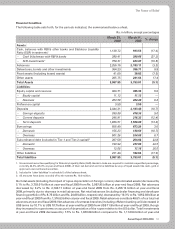

STANDALONE FINANCIALS AS PER INDIAN GAAP

Summary

Profit before provisions and tax increased by 12.1% to Rs. 89.25 billion in fiscal 2009 from Rs. 79.61 billion in

fiscal 2008 primarily due to an increase in net interest income by 14.6% to Rs. 83.67 billion in fiscal 2009 from

Rs. 73.04 billion in fiscal 2008 and decrease in non-interest expenses by 13.6% to Rs. 70.45 billion in fiscal 2009 from

Rs. 81.54 billion in fiscal 2008, offset, in part, by decrease in non-interest income by 13.7% to Rs. 76.03 billion in

fiscal 2009 from Rs. 88.11 billion in fiscal 2008. Provisions and contingencies (excluding provision for tax) increased

by 31.1% during fiscal 2009 due to a higher level of specific provisioning on non-performing loans, offset, in part,

by lower general provisioning as the advances portfolio did not increase. Profit before tax increased by 1.2%

to Rs. 51.17 billion in fiscal 2009 from Rs. 50.56 billion in fiscal 2008. Tax provision was Rs. 13.59 billion in fiscal