ICICI Bank 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F88

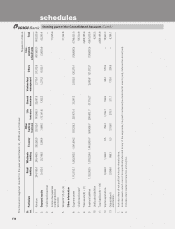

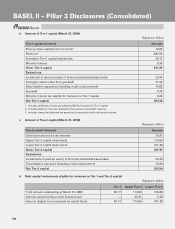

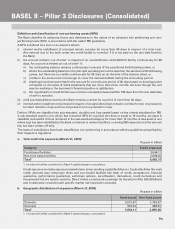

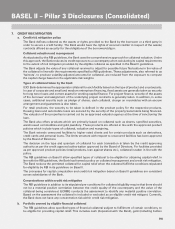

b. Capital requirements for various risk areas (March 31, 2009)

Rupees in billion

Risk area Amount1

Credit risk

Capital required

– Portfolio subject to standardised approach 325.78

– Securitisation exposure 2.36

Market risk

Capital required

– for interest rate risk 41.38

– for foreign exchange (including gold) risk 1.06

– for equity position risk 3.69

Operational risk

Capital required 21.14

Total capital requirement at 9% 395.42

Total capital funds of the Bank 647.04

Total risk weighted assets 4,393.50

Capital adequacy ratio 14.73%

1. Includes all entities considered for Basel II capital adequacy computation.

Capital adequacy ratio

Capital ratios Consolidated1ICICI Bank

Ltd.1

ICICI Bank

UK PLC2

ICICI Bank

Canada2

ICICI Bank

Eurasia LLC2,3

Tier-1 capital ratio 10.34% 11.84% 12.06% 18.55% N.A.

Total capital ratio 14.73% 15.53% 18.38% 19.89% 15.07%

1. Computed as per RBI guidelines on Basel II.

2. Computed as per capital adequacy framework guidelines issued by regulators of respective jurisdictions.

3. Total capital ratio is required to be reported in line with regulatory norms stipulated by Central Bank of Russia.

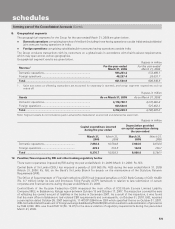

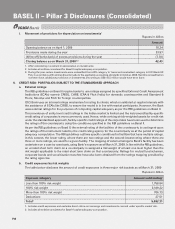

4. RISK MANAGEMENT FRAMEWORK

As a financial intermediary, the Bank is exposed to various types of risks including credit, market, liquidity,

operational, legal, compliance and reputation risks. The objective of the risk management framework at the Bank

is to ensure that various risks are understood, measured and monitored and that the policies and procedures

established to address these risks are strictly adhered to.

The key principles underlying the risk management framework at the Bank are as follows:

1. The Board of Directors has oversight on all the risks assumed by the Bank. Specific Committees of the Board

have been constituted to facilitate focused oversight of various risks. Risk Committee reviews risk management

policies in relation to various risks including portfolio, liquidity, interest rate, investment policies and strategy,

and regulatory and compliance issues in relation thereto. Credit Committee reviews developments in key

industrial sectors and the Bank’s exposure to these sectors as well as to large borrower accounts. Audit

Committee provides direction to and also monitors the quality of the internal audit function. Asset Liability

Management Committee is responsible for managing the balance sheet and reviewing the Bank’s asset-liability

position.

2. Policies approved from time to time by the Board of Directors/Committees of the Board form the governing

framework for each type of risk. The business activities are undertaken within this policy framework.

3. Independent groups and sub-groups have been constituted across the Bank to facilitate independent evaluation,

monitoring and reporting of various risks. These control groups function independently of the business groups/

sub-groups.

The risk management framework forms the basis of developing consistent risk principles across the Bank, overseas

branches and overseas banking subsidiaries.

Material risks are identified, measured, monitored and reported to the Board of Directors/Board level committees/

Committee of Directors through the following:

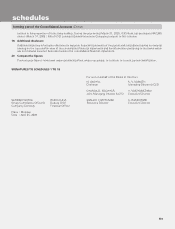

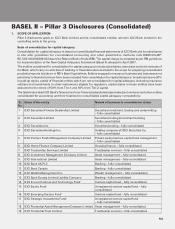

BASEL II – Pillar 3 Disclosures (Consolidated)