ICICI Bank 2009 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F103

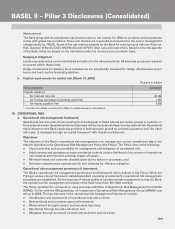

The ALM Policy of the Bank contains the prudential limits on liquidity and interest rate risk, as prescribed by the

Board of Directors/Risk Committee/ALCO. Any amendments to the ALM Policy can be proposed by business

group(s), in consultation with the market risk and compliance teams and are subject to approval from Board

of Directors/Risk Committee/ALCO, as per the authority defined in the Policy. The amendments so approved

by ALCO are presented to the Board of Directors/Risk Committee for information.

TMOG is responsible for preparing the various reports to monitor the adherence to the prudential limits as

per the ALM Policy. These limits are monitored on a regular basis at various levels of periodicity. Breaches, if

any, are duly reported to Board of Directors/Risk Committee/ALCO, as may be required under the framework

defined for approvals/ratification. Whenever the indicators point to an adverse impact on account of IRRBB,

ALCO suggests necessary corrective actions and re-alignment measures in order to mitigate the risk.

Each of the other entities in the Group, wherever applicable, also have organizational set ups and policies that

address the risks defined above.

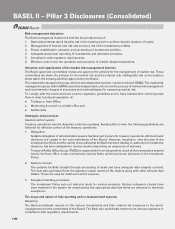

Risk measurement and reporting framework

The Bank proactively manages impact of IRRBB as a part of its ALM activities. ALM policy defines the different

types of interest rates risks that are to be monitored, measured and controlled. ALCO decides strategies for

managing IRRBB at the desired level. Further, ALCO periodically gives direction for management of interest

rate risk on the basis of its expectations of future interest rates. Based on the guidance, SRRMG and ALM

groups (in overseas branches) manage the IRRBB with the help of various tools viz. gap analysis, earnings at

risk (EaR), duration of equity (DoE), stress testing for basis risk etc. These tools are detailed hereunder:

Gap analysis: The interest rate gap or mismatch risk is measured by calculating gaps over different time

intervals as at a given date. This static analysis measures mismatches between rate sensitive liabilities (RSL)

and rate sensitive assets (RSA) (including off-balance sheet positions and trading positions). The report

is prepared fortnightly by grouping rate sensitive liabilities, assets and off-balance sheet positions into

time buckets according to residual maturity or next re-pricing period, whichever is earlier. The difference

between RSA and RSL for each time bucket signifies the gap in that time bucket. The direction of the gap

indicates whether net interest income is positively or negatively impacted by a change in interest rates

and the magnitude of the gap approximates the change in net interest income for any given interest rate

shift. There are bucket-wise limits that are linked to networth of the Bank.

EaR: From an EaR perspective, the gap reports indicate whether the Bank is in a position to benefit from

rising interest rates by having a positive gap (RSA > RSL) or whether it is in a position to benefit from

declining interest rates by a negative gap (RSL > RSA). The Bank monitors the EaR of NII to a 100 basis

points adverse change in the level of interest rates. The magnitude of the impact as a percentage of the

NII gives a fair measure of the earnings risk that the Bank is exposed to.

Stress test for basis risk: The assets and liabilities on the balance sheet are priced based on multiple

benchmarks and when interest rates fluctuate, all these various yield curves may not necessarily move in

tandem exposing the balance sheet to basis risk. Therefore, over and above the EaR, the Bank measures

the impact of different movement in interest rates across benchmark curves. Various scenarios of interest

rate movements (across various benchmark yield curves) are identified and the worst-case impact is

measured as a percentage of the aggregate of Tier-1 and Tier-2 capital. These scenarios take into account

the magnitude as well as the timing of various interest rate movements (across curves).

DoE: Change in the interest rates also have a long-term impact on the market value of equity of the

Bank, as the economic value of the Bank’s assets, liabilities and off-balance sheet positions get affected.

Duration is a measure of interest rate sensitivity of assets, liabilities and also equity. It may be defined as

the percentage change in the market value of an asset or liability (or equity) for a given change in interest

rates. Thus DoE is a measure of by how much the market value of equity of a firm would change for

the identified change in the interest rates. The Bank uses DoE as a part of framework to manage IRRBB

for its domestic and overseas operations and has devised limits for the above risk metrics in order to

monitor and manage IRRBB. The utilization against these limits is computed for appropriate interest rate

movements and monitored periodically.

Most of the other entities in the Group, wherever applicable, also monitor IRRBB through similar tools and

limit framework.

BASEL II – Pillar 3 Disclosures (Consolidated)