ICICI Bank 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F70

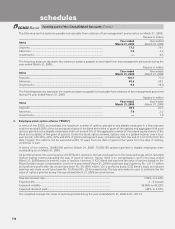

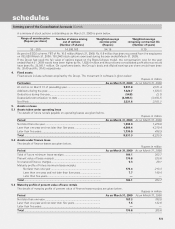

The following are the balances payable to/receivable from relatives of key management personnel as on March 31, 2009:

Rupees in million

Items Year ended

March 31, 2009 Year ended

March 31, 2008

Deposits ................................................................................................... 17.2 14.1

Advances .................................................................................................. 7.5 2.2

Investments.............................................................................................. —0.5

The following balances represent the maximum balance payable to/receivable from key management personnel during the

year ended March 31, 2009:

Rupees in million

Items Year ended

March 31, 2009 Year ended

March 31, 2008

Deposits ................................................................................................... 123.7 71.4

Advances .................................................................................................. 63.6 28.1

Investments.............................................................................................. 9.3 10.8

The following balances represent the maximum balance payable to/receivable from relatives of key management personnel

during the year ended March 31, 2009:

Rupees in million

Items Year ended

March 31, 2009 Year ended

March 31, 2008

Deposits ................................................................................................... 38.3 22.5

Advances .................................................................................................. 7.6 2.2

Investments.............................................................................................. —1.6

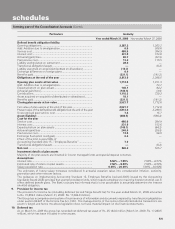

3. Employee stock option scheme (“ESOS”)

In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year

shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and aggregate of all such

options granted to the eligible employees shall not exceed 5% of the aggregate number of the issued equity shares of the

Bank on the date(s) of the grant of options. Under the stock option scheme, options vest in a graded manner over a four-

year period, with 20%, 20%, 30% and 30% of grants vesting each year, commencing from the end of 12 months from the

date of grant. The options can be exercised within 10 years from the date of grant or five years from the date of vesting,

whichever is later.

In terms of the scheme, 18,992,504 options (March 31, 2008: 15,638,152 options) granted to eligible employees were

outstanding as on March 31, 2009.

As per the scheme, the exercise price of ICICI Bank’s options is the last closing price on the stock exchange, which recorded

highest trading volume preceding the date of grant of options. Hence, there is no compensation cost for the year ended

March 31, 2009 based on intrinsic value of options. However, if ICICI Bank had used the fair value of options based on the

Black-Scholes model, compensation cost for the year ended March 31, 2009 would have been higher by Rs. 1,411.7 million

and proforma profit after tax would have been Rs. 36,169.6 million. On a proforma basis, ICICI Bank’s basic and diluted

earnings per share would have been Rs. 32.49 and Rs. 32.43 respectively. The key assumptions used to estimate the fair

value of options granted during the year ended March 31, 2009 are given below.

Risk-free interest rate .......................................................................................... 7.62% to 9.24%

Expected life ....................................................................................................... 2 – 6.4 years

Expected volatility ............................................................................................... 38.90% to 45.23%

Expected dividend yield ...................................................................................... 1.20% to 3.57%

The weighted average fair value of options granted during the year ended March 31, 2009 is Rs. 331.19.

forming part of the Consolidated Accounts (Contd.)

schedules