ICICI Bank 2009 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F92

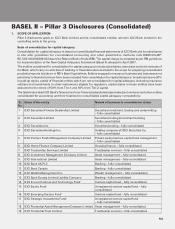

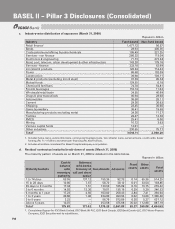

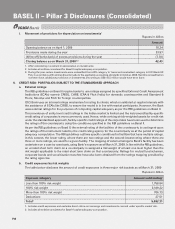

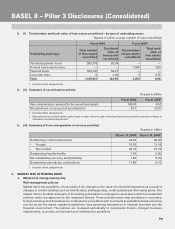

c. Industry-wise distribution of exposures (March 31, 2009)

Rupees in billion

Industry Fund-based Non-fund based

Retail finance11,477.12 50.57

Banks 28.93 406.36

Crude petroleum/refining & petrochemicals 195.49 221.25

Services - non finance 280.32 113.09

Electronics & engineering 71.73 273.34

Road, port, telecom, urban development & other infrastructure 143.20 178.16

Services - finance 233.10 62.69

Iron/steel & products 126.24 114.42

Power 88.68 102.09

Construction 39.90 103.11

Metal & products (excluding iron & steel) 37.59 95.54

Mutual funds 129.55 0.18

Chemical & fertilisers 74.70 54.81

Food & beverages 110.14 11.62

Wholesale/retail trade 34.55 46.69

Drugs & pharmaceuticals 46.94 28.68

Automobiles 38.30 28.11

Cement 29.36 30.83

Shipping 22.45 36.60

Gems & jewellery 38.41 19.58

Manufacturing products excluding metal 34.26 11.27

Textiles 28.47 13.56

FMCG 25.41 6.06

Mining 16.72 3.83

Venture capital funds 12.01 —

Other industries 230.55 75.77

Total23,594.11 2,088.20

1. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans, credit cards, dealer

funding (Rs. 11.11 billion) and developer financing (Rs. 49.07 billion).

2. Includes all entities considered for Basel II capital adequacy computation.

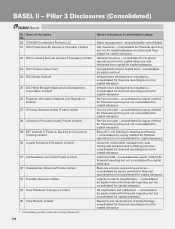

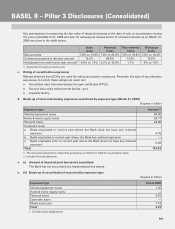

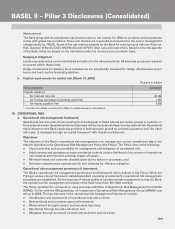

d. Residual contractual maturity break-down of assets (March 31, 2009)

The maturity pattern of assets as on March 31, 2009 is detailed in the table below.

Rupees in billion

Maturity buckets

Cash &

balance

with

monetary

authority

Balances

with banks

& money at

call and short

notice

Investments Advances

Fixed

assets

Other

assets Total

assets

1 to 14 days 63.55 137.12 155.35 92.73 0.14 65.36 514.25

15 to 28 days 10.80 7.67 58.72 28.12 0.01 33.54 138.85

29 days to 3 months 17.34 7.51 133.58 105.08 0.16 15.75 279.42

3 to 6 months 14.02 12.30 79.57 135.16 0.29 5.20 246.53

6 months to 1 year 17.23 4.92 103.82 258.43 2.84 7.41 394.64

1 to 3 years 40.60 1.90 334.89 993.96 0.62 14.68 1,386.68

3 to 5 years 2.22 — 56.78 572.66 0.20 5.27 637.12

Above 5 years 10.07 — 253.58 475.68 35.02 112.88 887.19

Total1175.83 171.42 1,176.28 2,661.80 39.27 260.08 4,484.69

1. Consolidated figures for ICICI Bank Limited, ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia LLC, ICICI Home Finance

Company, ICICI Securities and its subsidiaries.

BASEL II – Pillar 3 Disclosures (Consolidated)