ICICI Bank 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11Annual Report 2008-2009

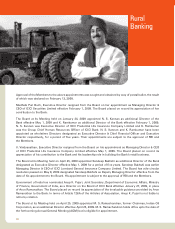

Believing in the potential

of rural India.

ICICI Bank is committed to expanding delivery of

financial services in India’s hinterland, enabling our

villages to participate in our nation’s progress.

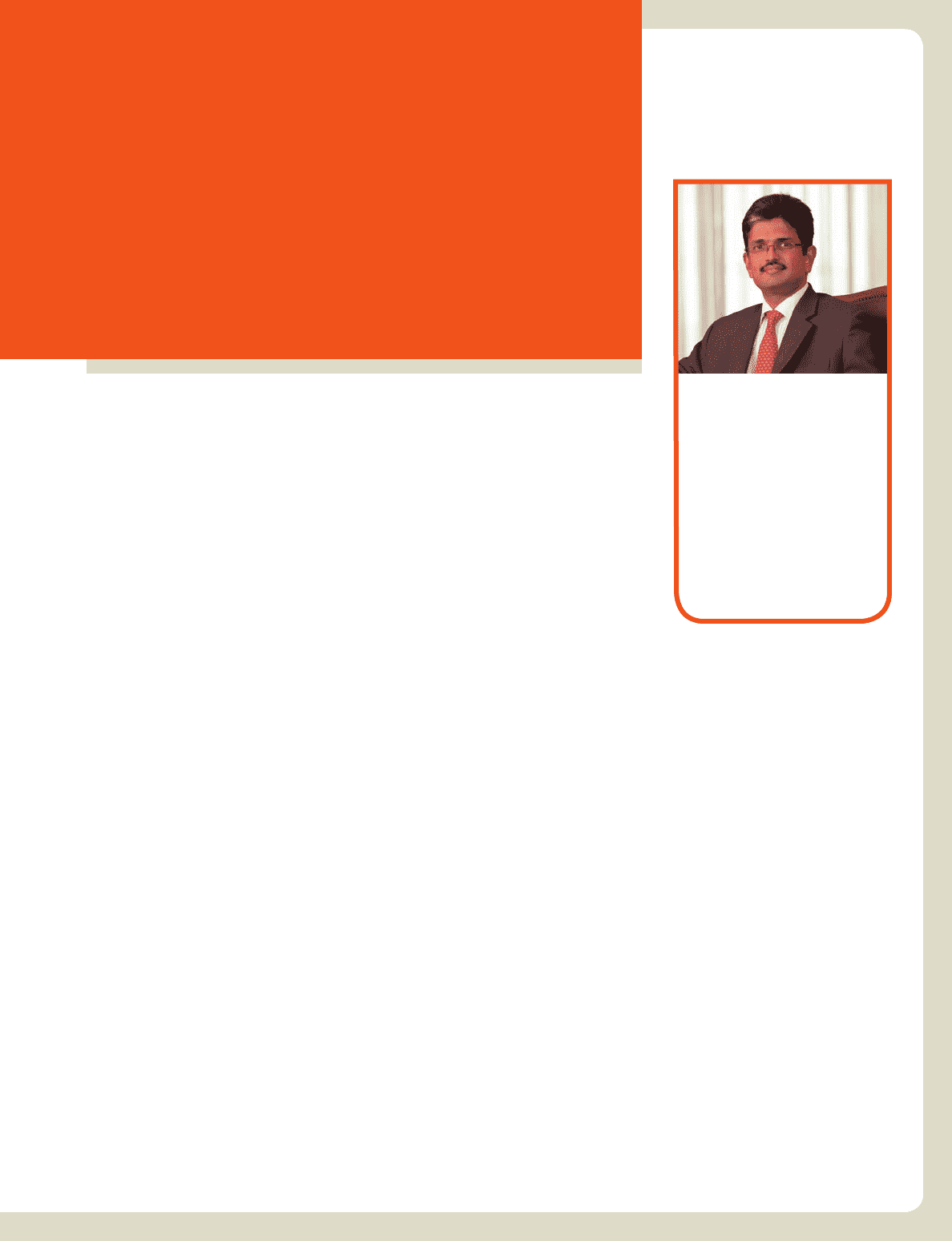

N. S. Kannan

Executive Director &

Chief Financial Officer

“We will continue to focus

on prudently managing

capital, controlling

expenses, reducing cost

of funds and containing

risks, so as to achieve

sustainable profitability and

long term returns to our

shareholders.”

The Power of Belief

In terms of the provisions of the Companies Act, 1956 and the Articles of

Association of the Bank, Anupam Puri, M. K. Sharma, P. M. Sinha and V. Prem

Watsa would retire by rotation at the forthcoming AGM and, being eligible, offer

themselves for re-appointment.

AUDITORS

The auditors, B S R & Co., Chartered Accountants, will retire at the ensuing AGM.

As recommended by the Audit Committee, the Board has proposed the

appointment of B S R & Co. as statutory auditors for fiscal 2010. Their appointment

has been approved by RBI vide its letter dated April 2, 2009. You are requested

to consider their appointment.

PERSONNEL

As required by the provisions of Section 217(2A) of the Companies Act, 1956,

read with Companies (Particulars of Employees) Rules, 1975, as amended, the

names and other particulars of the employees are set out in the Annexure to the

Directors’ Report.

APPOINTMENT OF NOMINEE DIRECTORS ON THE BOARDS

OF ASSISTED COMPANIES

ICICI had a policy of appointing nominee directors on the boards of certain

borrower companies based on loan covenants, with a view to enable monitoring

of the operations of those companies. Subsequent to the merger of ICICI with

ICICI Bank, the Bank continues to nominate directors on the boards of assisted

companies. Apart from the Bank’s employees, experienced professionals from

various fields are appointed as nominee Directors. At March 31, 2009, ICICI Bank

had 30 nominee Directors, of whom 23 were employees of the Bank, on the boards

of 41 assisted companies. The Bank has a Nominee Director Cell for maintaining

records of nominee directorships.

CORPORATE GOVERNANCE

ICICI Bank has established a tradition of best practices in corporate governance.

The corporate governance framework in ICICI Bank is based on an effective

independent Board, the separation of the Board’s supervisory role from the

executive management and the constitution of Board Committees, generally

comprising a majority of independent Directors and chaired by an independent

Director, to oversee critical areas.