ICICI Bank 2009 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F97

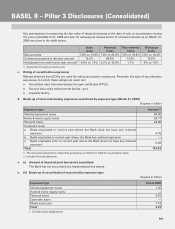

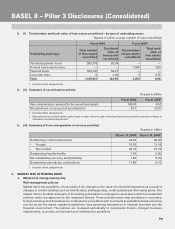

Key assumptions in measuring the fair value of retained interests at the date of sale or securitisation during

the year ended March 31, 2009 and also for subsequent measurement of retained interests as on March 31,

2009 are given in the table below.

Auto

loans Personal

loans Two wheeler

loans Mortgage

loans

Discount rate 7.0% to 15.8% 7.0% to 25.6% 7.0% to 18.8% 7.0% to 10.2%

Constant prepayment rate (per annum) 15.0% 42.0% 12.0% 10.0%

Anticipated net credit losses (per annum)10.4% to 1.4% 3.2% to 10.0% 1.1% 0% to 1.0%

1. Applicable for single product pools.

c. Rating of securitisation exposures

Ratings obtained from ECAIs are used for rating securisation exposures. Presently, the type of securitisation

exposures, for which these ratings are used, are:

Securitized debt instruments/pass through certificates (PTCs);

Second loss credit enhancement facility ; and

Liquidity facility.

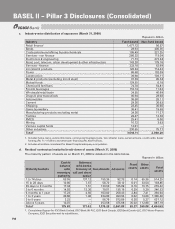

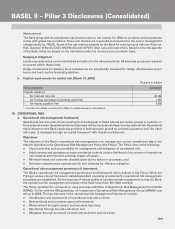

d. Break-up of total outstanding exposures securitised by exposure type (March 31, 2009)

Rupees in billion

Exposure type Amount1,2

Vehicle/equipment loans 69.05

Home & home equity loans 29.77

Personal loans 24.06

Corporate loans

a. Deals originated in current year where the Bank does not have any retained

exposure 4.75

b. Deals originated in current year where the Bank has retained exposure —

c. Deals originated prior to current year where the Bank does not have any retained

exposure 6.20

Total 133.83

1. The amounts represent the outstanding principal as on March 31, 2009 for securitisation deals.

2. Includes direct assignments.

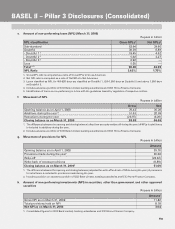

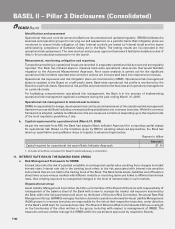

e. (i) Amount of impaired/past due assets securitized

The Bank has not securitized any impaired/past due assets.

e. (ii) Break-up of securitisation losses (net) by exposure type

Rupees in billion

Exposure type Fiscal 2009

Vehicle/equipment loans 1.35

Home & home equity loans —

Personal loans 0.67

Corporate loans —

Mixed asset pool 1.19

Total13.21

1. Includes direct assignments.

BASEL II – Pillar 3 Disclosures (Consolidated)