ICICI Bank 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F89

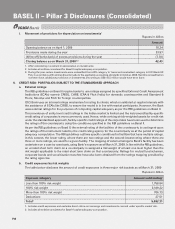

a. Key risk indicators

Key risk indicators have been developed pertaining to various risks such as credit risk, interest rate risk,

liquidity risk and foreign exchange risk, besides internal audit ratings. These indicators are presented at the

end of every quarter.

b. ICAAP/stress testing

As part of ICAAP, the Bank has conducted stress tests under various historical and hypothetical scenarios

and assessed the impact on its capital adequacy. The outcome of such exercise has been reported to RBI as

at March 31, 2008.

Stress test is being conducted as per the ICAAP methodology approved by the Board on periodical basis for

all the risks and reported to respective committees.

c. Stress tolerance limits

In line with stress testing results, risk tolerance limits have been formulated for various risks. The actual position

against the limits is being periodically reported to respective committees.

d. Analysis of irregularities

Status of arrears/irregularities is being monitored by independent control group and is reported quarterly to

Credit Committee.

e. Reporting against prudential exposure norms

Status of actual position against prudential exposure limits set by the Board/stipulated by RBI are reported

periodically to respective committees

Measurement of risks for capital adequacy purposes

Under Pillar 1 of the RBI guidelines on Basel II, the Bank currently follows the standardised approach for credit

and market risk and basic indicator approach (BIA) for operational risk. The Bank is in the process of setting up a

framework for the adoption of the advanced approaches under Basel II and aims to migrate to these approaches

in line with the required approval and time schedule stipulated by RBI.

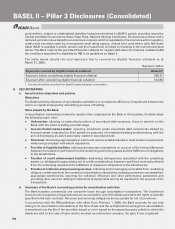

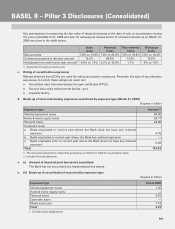

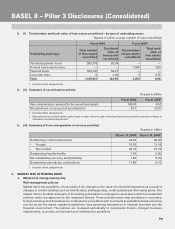

5. CREDIT RISK

The Bank is exposed to credit risk in its lending operations. Credit risk is the risk of loss that may occur from the

failure of any counterparty to abide by the terms and conditions of any financial contract with the Bank, principally

the failure to make required payments as per the terms and conditions of the contracts.

Policies and processes

All credit risk related aspects are governed by credit and recovery policy (Credit Policy), approved by the Board

of Directors. Credit Policy outlines the type of products that can be offered, customer categories, target customer

profile, credit approval process and prudential exposure limits.

Structure and organisation of the credit risk management group

The Global Credit Risk Management Group (GCRMG) is responsible for rating of the credit portfolio, tracking

changes in various industries and periodic reporting of portfolio-level changes. The GCRMG is segregated into

sub-groups for Corporate, Small Enterprises and Rural Micro-banking and Agri-business Group (RMAG) and Retail

businesses.

The overseas banking subsidiaries of the Bank have also established similar structures to ensure adequate risk

management, factoring in the risks particular to the respective businesses and the regulatory and statutory

guidelines. The risk heads of all overseas banking subsidiaries have a reporting relationship to the Head - Global

Risk Management Group (GRMG), in addition to reporting to the Chief Executive Officer of the respective

subsidiaries.

Credit risk assessment process

There is a structured and standardised credit approval process including a comprehensive credit risk assessment

process, which encompasses analysis of relevant quantitative and qualitative information to ascertain credit rating

of the borrower.

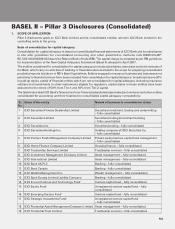

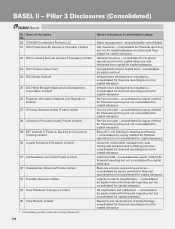

BASEL II – Pillar 3 Disclosures (Consolidated)