ICICI Bank 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59Annual Report 2008-2009

The Power of Belief

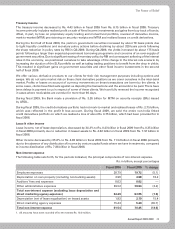

SEGMENTAL INFORMATION

RBI issued revised guidelines on segment reporting applicable from fiscal 2008. As per the guidelines, the business

operations of the Bank have following segments:

Retail Banking includes exposures which satisfy the four criteria of orientation, product, granularity and low value

of individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document

“International Convergence of Capital Measurement and Capital Standards: A Revised Framework”.

Wholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies which

are not included under the Retail Banking.

Treasury includes the entire investment portfolio of the Bank.

Other Banking includes hire purchase and leasing operations and other items not attributable to any particular

business segment.

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units

at appropriate rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve

requirements.

Despite challenges in the operating environment during the course of the year, profit before tax of the retail

banking segment was Rs. 0.58 billion in fiscal 2009 as compared to Rs. 9.47 billion in fiscal 2008. The profit before

tax of the retail banking segment was impacted primarily by the sharp increase in the interest rates in the banking

system which impacted the net interest income on the existing retail asset portfolio, and the higher credit losses

primarily on account of the challenges in collections and the deteriorating macroeconomic environment. Also, as

a risk containment measure, we had consciously moderated retail disbursements, which resulted in a lower level

of interest income and loan related fees. These challenges were partly offset by lower direct marketing agency

expenses due to lower disbursements during the year.

Profit before tax of the wholesale banking segment was marginally lower at Rs. 34.13 billion in fiscal 2009 as

compared to Rs. 35.75 billion in fiscal 2008. This was primarily due to the sharp downturn in the global economy

which resulted in a slowdown in the Indian economy and also impacted the Indian corporate sector. Corporate

clients had therefore slowed down their investment and overseas expansion plans which impacted our fees related

to investment and M&A activity of corporate clients during the second half of the year.

Profit before tax of the treasury banking segment was higher at Rs.12.84 billion in fiscal 2009 as compared to

Rs. 5.13 billion in fiscal 2008. With the easing of the monetary policy stance in October 2008, we positioned

ourselves to take advantage of the change in the interest rate scenario by increasing the duration of the SLR

portfolio as well as taking trading positions to benefit from the drop in yields. This resulted in higher profit before

tax of the treasury banking segment.

Profit before tax of the other banking segment was higher at Rs. 3.61 billion in fiscal 2009 as compared to

Rs. 0.21 billion in fiscal 2008. This was primarily due to completion of pending income tax assessments during

the course of the year, as a result of which we had received interest on income tax refund.

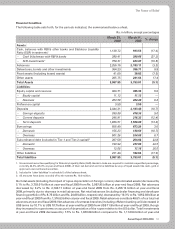

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

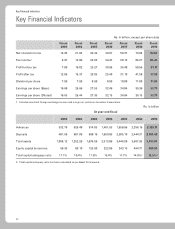

The consolidated profit after tax for fiscal 2009 including the results of operations of our subsidiaries and other

consolidating entities was Rs. 35.77 billion as compared to Rs. 33.98 billion for fiscal 2008.

ICICI Bank UK made a profit of Rs. 0.31 billion in fiscal 2009, as compared to Rs. 1.55 billion in fiscal 2008 due to

increase in impairment loss mainly pertaining to provision made for investments in Lehman Brothers and other

investments, offset, in part, by profit of Rs. 4.02 billion on buy-back of bonds. ICICI Bank UK’s mark-to-market loss

on investments made through profit and loss accounts was Rs. 0.56 billion (US$ 12 million).

In October 2008, the UK Accounting Standards Board amended FRS 26 on ‘Financial Instruments: Recognition

and Measurement’ and permitted reclassification of financial assets in certain circumstances from the ‘held for

trading (HFT)’ category to the ‘available for sale (AFS)’ category, HFT category to the ‘loans and receivables’

category and from the AFS category to the ‘loans and receivables’ category. Pursuant to these amendments, during

fiscal 2009, ICICI Bank UK has transferred certain assets with fair value of Rs. 34.03 billion (US$ 671 million) from

the HFT category to the AFS category, certain assets with fair value of Rs. 0.12 billion (US$ 2 million) from the

HFT category of investments to ‘loans and receivables’ category and certain assets with fair value of Rs. 20.39 billion