ICICI Bank 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F33

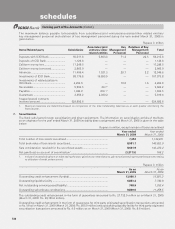

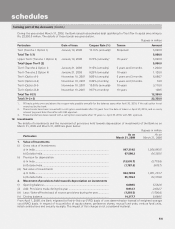

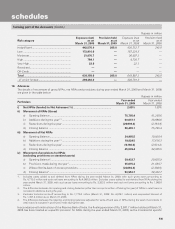

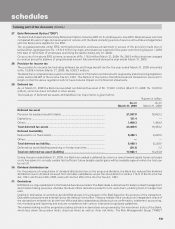

ii) Non-performing investments in securities, other than government and other approved securities

The movement in gross non-performing investments in securities, other than government and other approved securities

for the year ended March 31, 2009 and March 31, 2008 is given below:

Rupees in million

Particulars Year ended

March 31, 2009 Year ended

March 31, 2008

Opening balance ............................................................................................. 3,689.6 3,083.1

Additions during the year ................................................................................ 278.7 851.3

Reduction during the year ............................................................................... (139.2) (244.8)

Closing balance ............................................................................................... 3,829.1 3,689.6

Total provisions held ....................................................................................... 3,213.8 2,276.3

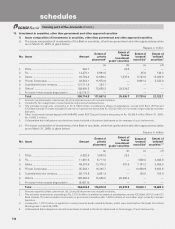

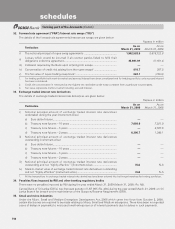

14. Repurchase transactions

The details of securities sold and purchased under repos and reverse repos during the year ended March 31, 2009 and

March 31, 2008 are given below:

Rupees in million

Minimum

outstanding

balance during

the year

Maximum

outstanding

balance during

the year

Daily average

outstanding

balance during

the year

Balance as on

year end

Year ended March 31, 2009

Securities sold under repurchase transaction ...... — 145,875.0 66,861.3 22,092.3

Securities purchased under reverse repurchase

transaction ............................................................ — 10,499.7 31.5 —

Year ended March 31, 2008

Securities sold under repurchase transaction ...... — 101,463.6 34,644.5 24,496.8

Securities purchased under reverse repurchase

transaction ............................................................ — 23,044.2 1,330.2 —

1. The above figures do not include securities sold and purchased under Liquidity Adjustment Facility (“LAF”) of RBI.

2. The above figures are for Indian branches only.

3. Minimum, maximum & average outstanding is based on first leg of transaction & balance outstanding is based on book value.

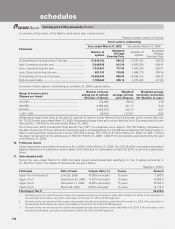

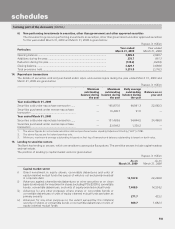

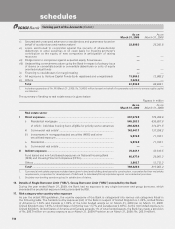

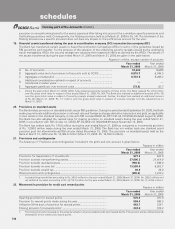

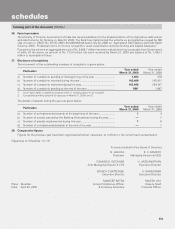

15. Lending to sensitive sectors

The Bank has lending to sectors, which are sensitive to asset price fluctuations. The sensitive sectors include capital markets

and real estate.

The position of lending to capital market sector is given below:

Rupees in million

As on

March 31, 2009 As on

March 31, 2008

Capital market sector

i) Direct investment in equity shares, convertible debentures and units of

equity-oriented mutual funds the corpus of which is not exclusively invested

in corporate debt 13,167.9 29,240.6

ii) Advances against shares/bonds/debentures or other securities or on clean

basis to individuals for investment in shares (including IPOs/ESOPs), convertible

bonds, convertible debentures, and units of equity-oriented mutual funds 7,408.5 14,324.2

iii) Advances for any other purposes where shares or convertible bonds or

convertible debentures or units of equity oriented mutual funds are taken as

primary security 271.7 423.2

iv) Advances for any other purposes to the extent secured by the collateral

security of shares or convertible bonds or convertible debentures or units of

equity oriented mutual funds 609.7 1,692.3

forming part of the Accounts (Contd.)

schedules