ICICI Bank 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F6

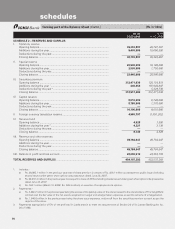

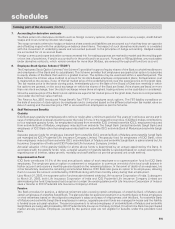

schedules

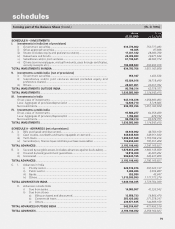

forming part of the Balance Sheet (Contd.) (Rs. in ‘000s)

As on

31.03.2009 As on

31.03.2008

SCHEDULE 2 – RESERVES AND SURPLUS

I. Statutory reserve

Opening balance .............................................................................................. 39,393,807 28,787,307

Additions during the year ................................................................................. 9,400,000 10,606,500

Deductions during the year.............................................................................. ——

Closing balance ................................................................................................ 48,793,807 39,393,807

II. Special reserve

Opening balance .............................................................................................. 20,940,000 19,190,000

Additions during the year ................................................................................. 2,500,000 1,750,000

Deductions during the year.............................................................................. ——

Closing balance ................................................................................................ 23,440,000 20,940,000

III. Securities premium

Opening balance .............................................................................................. 312,471,030 120,154,919

Additions during the year 1 ............................................................................... 446,352 197,644,847

Deductions during the year 2 ........................................................................... —5,328,736

Closing balance ................................................................................................ 312,917,382 312,471,030

IV. Capital reserve

Opening balance .............................................................................................. 8,010,000 6,740,000

Additions during the year ................................................................................. 8,180,000 1,270,000

Deductions during the year.............................................................................. ——

Closing balance ................................................................................................ 16,190,000 8,010,000

V Foreign currency translation reserve ............................................................... 4,966,797 (1,391,262)

VI. Reserve fund

Opening balance .............................................................................................. 4,528 1,390

Additions during the year 3 ............................................................................... 4,221 3,138

Deductions during the year.............................................................................. ——

Closing balance ................................................................................................ 8,749 4,528

VII. Revenue and other reserves

Opening balance .............................................................................................. 49,784,047 49,784,047

Additions during the year ................................................................................. ——

Deductions during the year.............................................................................. ——

Closing balance ................................................................................................ 49,784,047 49,784,047

VIII. Balance in profit and loss account ................................................................... 28,096,510 24,363,159

TOTAL RESERVES AND SURPLUS ....................................................................... 484,197,292 453,575,309

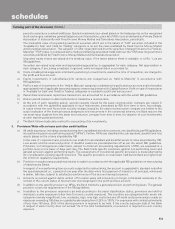

1. Includes:-

a) Rs. 98,865.1 million in the previous year (net of share premium in arrears of Rs. 486.1 million) consequent to public issue (including

shares issued under green shoe option) vide prospectus dated June 26, 2007.

b) Rs. 98,237.4 million in the previous year consequent to issue of ADSs (including shares issued under green shoe option) vide prospectus

dated June 23, 2007.

c) Rs. 184.1 million (March 31, 2008: Rs. 542.3 million) on exercise of employee stock options.

2. Represents:-

a) Rs. 3,482.2 million in the previous year being the excess of the paid-up value of the shares issued to the shareholders of The Sangli Bank

Limited over the fair value of the net assets acquired on merger and amalgamation expenses as per the scheme of amalgamation.

b) Rs. 1,846.6 million in the previous year being the share issue expenses, written-off from the securities premium account as per the

objects of the issue.

3. Represents appropriation of 5% of net profit by Sri Lanka branch to meet the requirements of Section 20 of Sri Lankan Banking Act No.

30 of 1988.