ICICI Bank 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Business Overview

Global Markets Group, comprising our global client-centric treasury operations.

Corporate Centre, comprising financial reporting; planning and strategy; asset liability management; investor

relations; secretarial; corporate communications; risk management; compliance; internal audit; legal; financial

crime prevention and reputation risk management; and the Bank’s proprietary trading operations across

various markets.

Human Resources Management Group, which is responsible for the Bank’s recruitment, training, leadership

development and other personnel management functions and initiatives.

Global Operations & Middle Office Groups, which are responsible for back-office operations, controls and

monitoring for our domestic and overseas operations.

Organisational Excellence Group, which is responsible for enterprise-wide quality and process improvement

initiatives.

Technology Management Group, which is responsible for enterprise-wide technology initiatives, with dedicated

teams serving individual business groups and managing information security and shared infrastructure.

Global Infrastructure & Administration Group, which is responsible for management of corporate facilities

and administrative support functions.

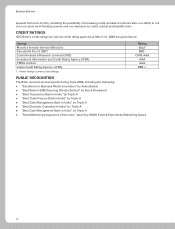

BUSINESS REVIEW

Fiscal 2009 was a year of unprecedented volatility. The first half of the year saw high inflation and interest rates but

the business environment continued to be robust with continued investments by the corporate sector. However,

the second half of the year was impacted by the global financial and liquidity crisis and loss of business confidence.

Given the volatile operating environment, the focus of the Bank was on capital conservation, liquidity management

and risk containment. At the same time we continued to grow our branch network with a focus on increasing our

low cost and retail deposit base while maintaining a strict control on operating expenses.

Retail Banking

Fiscal 2009 saw a further slowdown in retail credit growth in the banking system due to a volatile interest rate

environment, high asset prices and the impact of economic slowdown on consumer spending. Retail credit growth

of scheduled commercial banks has now decreased from about 30% over the last few years to about 15% in fiscal

2008 and to less than 10% in fiscal 2009.

The retail credit business requires a high level of credit and analytical skills and strong operations processes

backed by technology. Our retail strategy is centered on a wide distribution network, comprising our branches

and offices and dealer and real estate developer relationships; a comprehensive and competitive product suite;

technology-enabled back-office processes; and a robust credit and analytical framework.

During fiscal 2009, we focused on risk containment in the retail credit business. We tightened our lending norms

and moderated our disbursements, especially in the unsecured retail loans segment. However, we continue to

believe that retail credit has robust long-term growth potential, driven by sound fundamentals, namely, rising

income levels and favourable demographic profile. We are the largest provider of retail credit in India with a total

retail portfolio of Rs. 1,062.03 billion at March 31, 2009, constituting 49% of our total loans.

During fiscal 2009, we focused on increasing the proportion of low-cost retail deposits in our funding base.

Our current and savings account (CASA) deposits as a percentage of total deposits increased from 26.1% at

March 31, 2008 to 28.7% at March 31, 2009. We continued to expand our branch network during the year. Our

branch network has now increased from 755 branches & extension counters at March 31, 2007 to 1,262 branches

& extension counters at March 31, 2008 and 1,419 branches & extension counters at March 31, 2009. We have also

received licenses for 580 additional branches from RBI. Our strategy is to fully leverage the branch network for

sales and service of the entire range of liability, asset and fee-based products and services to retail customers.

In conjunction with the expansion in branch network, we have continued to expand our electronic channels, namely

internet banking, mobile banking, call centres and ATMs, and migrate customer transaction volumes to these

channels. We increased our ATM network to 4,713 ATMs at March 31, 2009 from 3,881 ATMs at March 31, 2008.

Our call centres have a total seating capacity of approximately 4,150 sales and service workstations. Transaction

volumes on internet and mobile banking have grown significantly, constituting an increasing percentage of total

customer transactions.

Cross-selling new products and also the products of our life and general insurance subsidiaries to our existing

customers is a key focus area for the Bank. Cross-sell allows us to deepen our relationship with our existing

customers and helps us reduce origination costs as well as earn fee income. The expanded branch network has